Are you wondering, “Can I get a mortgage?” Read this comprehensive guide to understand the process of obtaining a mortgage and fulfill your dream of homeownership.

When it comes to buying a home, many people often find themselves asking the question, “Can I get a mortgage?” Securing a mortgage is a crucial step towards fulfilling the dream of homeownership. In this article, we will provide you with a comprehensive guide to understanding the process of obtaining a mortgage. Whether you’re a first-time homebuyer or looking to upgrade to a new property, this article will equip you with the necessary knowledge to navigate the mortgage application process confidently.

What is a Mortgage?

A mortgage is a loan provided by a financial institution or lender to help individuals or families purchase a home. It is a legal agreement where the property acts as collateral, allowing the lender to repossess the property if the borrower fails to repay the loan.

Understand Mortgage Prequalification & Preapproval

Pre-Qualification:

Pre-qualification is an initial step in the mortgage process. It involves providing basic financial information to a lender, such as your income, assets, and debts. Based on this information, the lender will provide an estimate of the loan amount you may qualify for. Pre-qualification is typically a quick and informal process that can often be done online or over the phone.

Pre-Approval:

Pre-approval is a more formal and comprehensive process compared to pre-qualification. It involves submitting detailed financial documents to the lender, including income statements, tax returns, bank statements, and employment history. The lender evaluates these documents, runs a credit check, and assesses your financial profile.

Key Differences:

Verification: Pre-qualification is based on self-reported information, while pre-approval involves verifying the provided financial documents.

Confidence: Pre-approval gives you a more accurate understanding of the loan amount you can borrow, giving you confidence when house hunting.

Credibility: Pre-approval signals to sellers that you are a qualified buyer, potentially giving you an advantage in competitive markets.

Timing: Pre-qualification is a quick process, often done in minutes or hours, while pre-approval takes longer, typically a few days to a couple of weeks.

Note:- Both pre-qualification and pre-approval are valuable steps in the mortgage process. Pre-qualification helps you estimate your borrowing capacity, while pre-approval strengthens your offer and provides a more accurate assessment of your eligibility for a mortgage. It’s important to note that neither pre-qualification nor pre-approval guarantee final loan approval, as additional factors will be considered during the underwriting process.

Factors Affecting Mortgage Approval

Several factors influence the approval of a mortgage application. These include your credit score, employment history, income stability, debt-to-income ratio, and the property’s appraisal value. Lenders evaluate these factors to determine your ability to repay the loan.

Different Types of Mortgages

There are various types of mortgages available to homebuyers. Some common types include conventional mortgages, FHA loans, VA loans, and USDA loans. Each type has its own eligibility criteria and down payment requirements.

Fixed-Rate vs. Adjustable-Rate Mortgages

Fixed-rate mortgages have a consistent interest rate throughout the loan term, offering stability and predictability. On the other hand, adjustable-rate mortgages (ARMs) have an interest rate that may fluctuate after an initial fixed-rate period. Understanding the differences between these two options is crucial in selecting the mortgage that aligns with your financial goals and risk tolerance.

Choosing the Right Mortgage Lender

Selecting the right mortgage lender is essential for a smooth borrowing experience. Research different lenders, compare their interest rates, fees, customer reviews, and reputation. Consider factors such as customer service, responsiveness, and the lender’s ability to cater to your specific needs. Taking the time to find a reliable and reputable lender can make a significant difference in your mortgage journey.

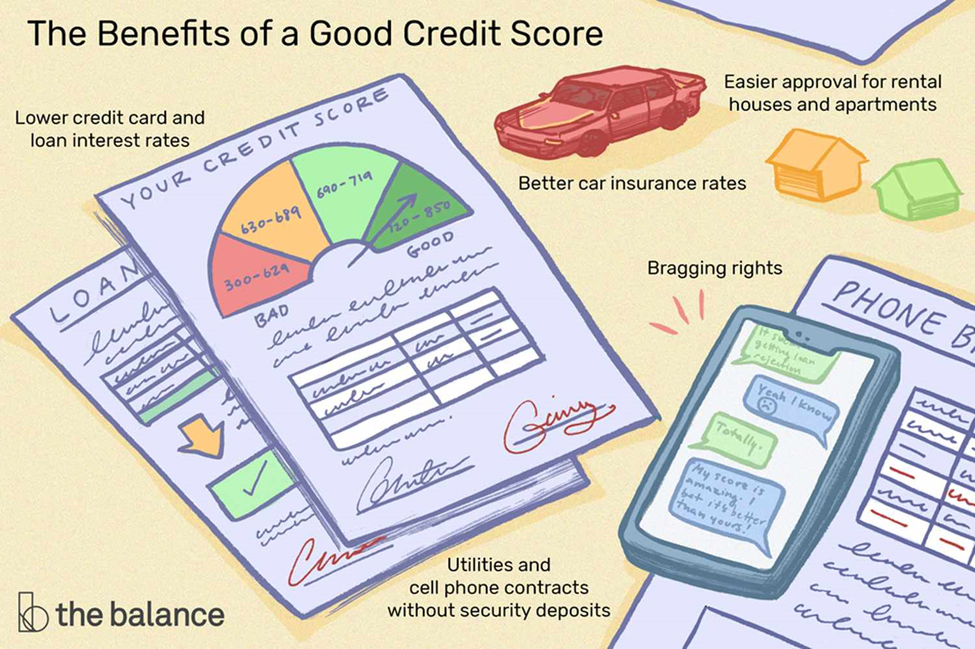

The Importance of Credit Scores

Credit scores play a vital role in mortgage approval. Lenders use credit scores to assess your creditworthiness and determine the interest rate you qualify for. Maintaining a good credit score by paying bills on time, minimizing debt, and avoiding new credit applications can increase your chances of securing a favorable mortgage.

Down Payments and Mortgage Insurance

Most mortgages require a down payment, which is a percentage of the home’s purchase price paid upfront. The amount of the down payment can vary based on the type of mortgage and other factors. Additionally, if your down payment is less than 20% of the home’s value, you may be required to pay for mortgage insurance. Understanding these costs is crucial when planning your budget for homeownership.

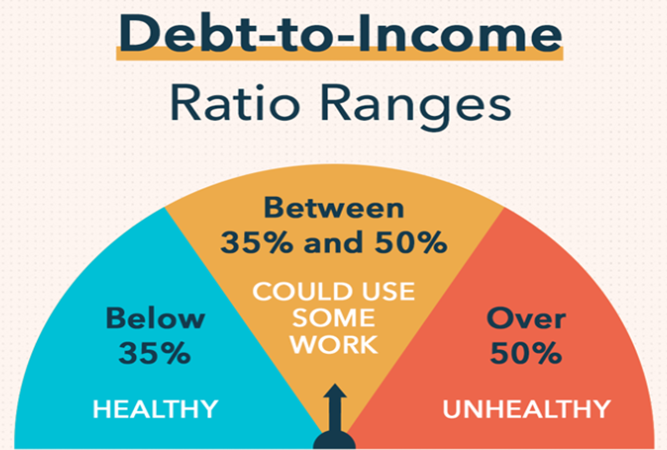

The Role of Debt-to-Income Ratio

Debt-to-income ratio (DTI) is a measure of your monthly debt payments compared to your gross monthly income. Lenders use DTI to assess your ability to manage mortgage payments along with other debts. Maintaining a healthy DTI ratio is important for mortgage approval. Paying off existing debts and avoiding new debts can improve your DTI ratio and increase your chances of mortgage success.

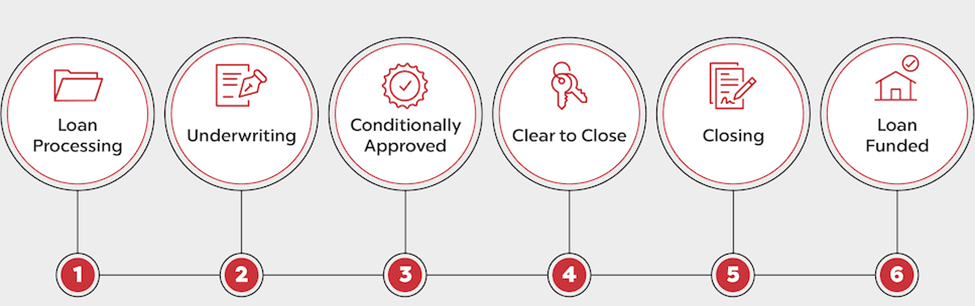

The Mortgage Application Process

The mortgage application process involves several steps, including submitting financial documents, completing an application form, and undergoing a thorough evaluation by the lender. It’s important to be prepared with all the necessary paperwork, such as income statements, tax returns, bank statements, and identification documents. Familiarize yourself with the process to ensure a smooth and efficient application experience.

Documents Required for a Mortgage

When applying for a mortgage, you will need to provide various documents to support your application. These documents may include income verification, tax returns, employment history, bank statements, and proof of identification. Having these documents readily available can streamline the application process and help you avoid unnecessary delays.

Mortgage Closing Process

The mortgage closing process is the final step before the loan is funded. It involves reviewing and signing the loan documents, paying closing costs, and transferring ownership of the property. Closing can be a complex process, and it’s important to carefully review all the documents and seek clarification on any terms or fees you don’t understand.

Tips for a Successful Mortgage Approval

- To increase your chances of a successful mortgage approval, consider the following tips:

- Maintain a good credit score by paying bills on time and managing debts responsibly.

- Save for a down payment and budget for additional homeownership costs.

- Choose a mortgage lender that offers competitive rates and excellent customer service.

- Gather all the necessary documents and be prepared for the application process.

- Seek preapproval to strengthen your offer when making an offer on a home.

How to Improve Your Chances of Getting a Mortgage

If you face challenges in getting a mortgage, there are steps you can take to improve your chances:

- Improve your credit score: Pay off outstanding debts, correct any errors on your credit report, and maintain good credit habits.

- Save for a larger down payment: A larger down payment can lower your loan-to-value ratio and show lenders that you are financially responsible.

- Reduce your debt: Pay down existing debts to lower your debt-to-income ratio and demonstrate your ability to manage your financial obligations.

- Increase your income: Consider ways to increase your income, such as taking on a second job or starting a side business, to strengthen your financial profile.

- Consider a co-signer: If your credit or income is insufficient, a co-signer with a strong credit history may help you secure a mortgage.

Common Mortgage Mistakes to Avoid

Avoid these common mortgage mistakes to ensure a smoother process:

- Not shopping around for the best mortgage rates and terms.

- Failing to budget for additional homeownership costs such as property taxes, insurance, and maintenance.

- Taking on new debts or making major purchases before or during the mortgage application process.

- Providing incomplete or inaccurate information on your application.

- Ignoring the importance of a home inspection before finalizing the purchase.

Achieving Your Homeownership Dream

Obtaining a mortgage is a significant milestone on the path to homeownership. By understanding the mortgage application process, exploring different types of mortgages, and taking steps to improve your financial profile, you can increase your chances of getting a mortgage that suits your needs. Remember to approach the process with careful consideration, seek professional advice when needed, and make informed decisions to make your dream of owning a home a reality.

- Can I get a mortgage if I have a low credit score?

- Yes, it’s possible to get a mortgage with a low credit score. However, a higher credit score improves your chances of securing a mortgage with more favorable terms and interest rates.

- How much down payment do I need to get a mortgage?

- The down payment requirements vary depending on the type of mortgage and the lender. Generally, a down payment of 20% or more is recommended to avoid mortgage insurance. However, there are programs available that allow for lower down payments.

- Can self-employed individuals qualify for a mortgage?

- Yes, self-employed individuals can qualify for a mortgage. However, the process may require additional documentation and proof of income stability.

- What is mortgage insurance, and do I need it?

- Mortgage insurance is required for certain loans with a down payment of less than 20%. It protects the lender in case of borrower default. It’s important to understand the specific requirements of your mortgage and the associated costs of mortgage insurance.

- How long does the mortgage approval process take?

- The mortgage approval process can vary depending on various factors such as the lender’s efficiency, complexity of the application, and responsiveness of the borrower. On average, it takes around 30 to 45 days from application to closing.

- What is a mortgage preapproval?

- Mortgage preapproval is an evaluation by a lender to determine how much they are willing to lend you based on your financial information. It provides you with a better understanding of your budget and helps you make a stronger offer when buying a home.

- Can I get a mortgage if I have student loan debt?

- Yes, having student loan debt doesn’t automatically disqualify you from getting a mortgage. Lenders consider your overall financial picture, including your debt-to-income ratio, when assessing your eligibility.

- Should I get a fixed-rate or adjustable-rate mortgage?

- The choice between a fixed-rate and adjustable-rate mortgage depends on your financial goals and risk tolerance. A fixed-rate mortgage offers stability with a consistent interest rate, while an adjustable-rate mortgage may have a lower initial rate but can fluctuate over time.

- How much income do I need to qualify for a mortgage?

- The income requirements vary depending on the lender and the loan program. Lenders typically evaluate your debt-to-income ratio, which compares your monthly debts to your gross income, to determine your eligibility.

- Can I get a mortgage if I’ve had a bankruptcy or foreclosure in the past?

- It is possible to get a mortgage after bankruptcy or foreclosure, but there may be waiting periods and specific requirements. The length of time since the bankruptcy or foreclosure and your credit history afterward will be considered by lenders.

Leave a Reply