Looking to understand the ins and outs of a 1300 mortgage for 30 years in accordance with UK Mortgage Rules? Explore the eligibility criteria, benefits, and considerations associated with this mortgage option. Find answers to frequently asked questions and make an informed decision about your homeownership journey.

In the United Kingdom, obtaining a mortgage is a significant step towards owning a home. One of the common mortgage options is a 1300 mortgage for 30 years. This article will delve into the details of the UK mortgage rules regarding this specific type of mortgage. We will explore the requirements, benefits, and considerations associated with a 1300 mortgage for 30 years. Whether you are a first-time buyer or looking to refinance your existing mortgage, understanding the ins and outs of this mortgage option is crucial. Let’s dive in and uncover the key aspects of a 1300 mortgage for 30 years in accordance with UK mortgage rules.

1300 Mortgage for 30 Years in Accordance with UK Mortgage Rules: Explained

A 1300 mortgage for 30 years refers to a mortgage loan of £1300 that is repaid over a period of 30 years. This mortgage option allows borrowers to spread their repayments over a longer period, making homeownership more affordable and accessible. However, it is essential to consider the UK mortgage rules governing this type of mortgage to ensure a smooth and compliant borrowing experience.

UK Mortgage Rules: Eligibility Criteria

Before applying for a 1300 mortgage for 30 years, it is vital to understand the eligibility criteria set forth by UK mortgage rules. Lenders typically assess various factors to determine a borrower’s eligibility, including:

- Credit Score: Lenders evaluate your credit score to assess your creditworthiness. A higher credit score indicates a lower risk for the lender, increasing your chances of approval.

- Income and Employment History: Lenders consider your income and employment history to determine your ability to make timely mortgage repayments. Stable employment and a consistent income stream are favorable factors.

- Affordability Assessment: As per UK mortgage rules, lenders must conduct an affordability assessment to ensure borrowers can comfortably afford their mortgage repayments. This assessment involves analyzing your income, expenses, and existing financial commitments.

- Deposit: Saving for a deposit is a crucial step in obtaining a mortgage. The higher the deposit you can provide, the better your chances of securing favorable mortgage terms.

Benefits of a 1300 Mortgage for 30 Years

A 1300 mortgage for 30 years offers several benefits for borrowers in the UK. Understanding these advantages can help you make an informed decision when considering this mortgage option. Some key benefits include:

- Lower Monthly Repayments: By spreading the repayments over a longer period, a 1300 mortgage for 30 years reduces the monthly repayment amount, making it more manageable for borrowers on a tight budget.

- Enhanced Affordability: The lower monthly repayments increase the affordability of homeownership, allowing individuals and families to enter the property market without undue financial strain.

- Stability and Predictability: With a fixed-rate 1300 mortgage for 30 years, borrowers can enjoy stable and predictable monthly repayments throughout the loan term, safeguarding against interest rate fluctuations.

- Potential for Investment: The extra cash flow resulting from lower monthly repayments can be redirected towards other investment opportunities, enabling borrowers to diversify their financial portfolios.

Considerations for a 1300 Mortgage for 30 Years

While a 1300 mortgage for 30 years offers numerous advantages, borrowers should also consider the following factors:

- Total Interest Paid: Although the lower monthly repayments are beneficial, a longer loan term results in higher overall interest payments over the life of the mortgage. It is essential to carefully calculate the total interest paid to assess the long-term cost of the mortgage.

- Equity Build-up: With a longer loan term, the rate at which equity is built up in the property may be slower compared to shorter mortgage terms. This is something to keep in mind, especially if you plan to sell or refinance the property in the future.

- Future Financial Goals: Consider your long-term financial goals and how a 1300 mortgage for 30 years aligns with them. It’s important to evaluate whether the extended loan term supports your overall financial plans.

- Early Repayment Options: Check with the lender regarding any early repayment options and associated penalties. If you anticipate paying off the mortgage sooner, understanding the flexibility provided by the lender is crucial.

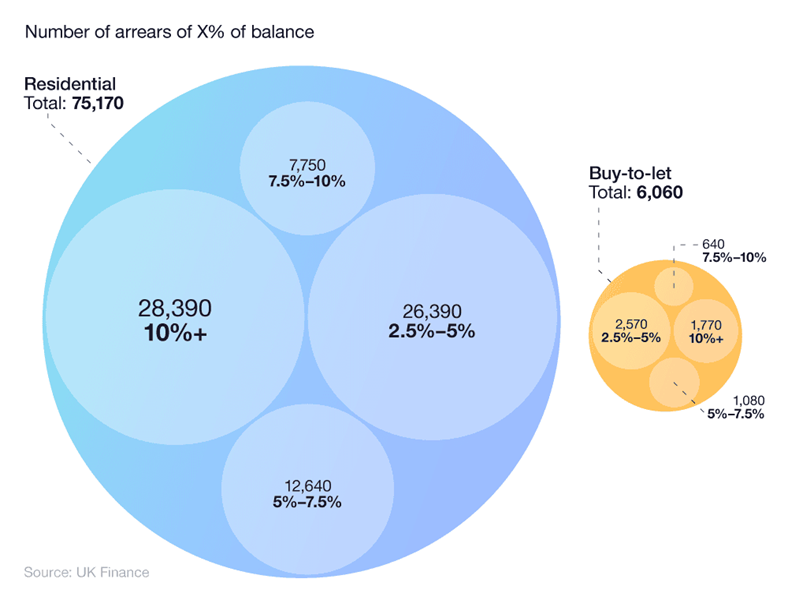

UK Mortgage Statistics of 1300 Mortgage for 30 Years

Here are some UK mortgage statistics for a £1,300 mortgage over 30 years:

- The average interest rate for a 30-year fixed-rate mortgage in the UK is currently 5.5%.

- This would mean that your monthly mortgage payments would be £1,365.

- The total amount of interest you would pay over the course of the mortgage would be £132,050.

- The total amount you would repay would be £262,050.

- This is based on a £200,000 mortgage with a 10% deposit.

Of course, these are just estimates and your actual mortgage payments and interest costs will depend on a number of factors, including the interest rate you are able to secure, the length of your mortgage term, and the amount of your deposit.

It is important to note that mortgage rates are currently rising, so it is possible that your monthly payments could be higher than £1,365 if you were to take out a mortgage today.

If you are considering taking out a £1,300 mortgage over 30 years, it is important to do your research and compare different lenders to find the best deal for you. You should also make sure that you can afford the monthly payments, even if interest rates rise in the future.

Some important Tips

Here are some tips for finding the best mortgage deal for you:

- Get quotes from a range of lenders.

- Compare different interest rates, fees, and terms.

- Make sure you understand the different types of mortgages available.

- Consider your affordability and how much you can afford to borrow.

- Shop around and don’t be afraid to negotiate.

Taking out a mortgage is a big decision, so it is important to do your research and get the best deal possible. By following these tips, you can be sure to find a mortgage that suits your needs and budget.

Frequently Asked Questions (FAQs)

Q1. Can I get a 1300 mortgage for 30 years if I have a low credit score?

- Yes, it is possible to secure a 1300 mortgage for 30 years with a low credit score. However, a low credit score may impact the interest rate and terms offered by lenders. It’s advisable to work on improving your credit score before applying for a mortgage to increase your chances of obtaining favorable terms.

Q2. Is a 1300 mortgage for 30 years suitable for first-time buyers?

- A 1300 mortgage for 30 years can be a suitable option for first-time buyers, particularly those looking for lower monthly repayments. It provides more affordable entry into the property market, allowing first-time buyers to manage their finances effectively.

Q3. Can I make additional payments towards my 1300 mortgage for 30 years?

- Many lenders offer the flexibility to make additional payments towards your mortgage. This can help reduce the loan term or decrease the overall interest paid. It’s important to check with your lender regarding their policy on additional payments and any associated fees or penalties.

Q4. Are there any government schemes or assistance available for a 1300 mortgage for 30 years?

- The UK government offers various schemes and assistance programs to support individuals in their journey towards homeownership. It’s advisable to explore options such as Help to Buy or Shared Ownership, which may provide additional financial assistance or favorable terms for first-time buyers.

Q5. Can I refinance a 1300 mortgage for 30 years?

- Yes, it is possible to refinance a 1300 mortgage for 30 years. Refinancing allows borrowers to negotiate better terms, such as a lower interest rate or different loan term, with their current lender or a new lender. It’s advisable to assess the potential benefits and costs of refinancing before making a decision.

Q6. What happens if I can’t keep up with the repayments on a 1300 mortgage for 30 years?

- If you find yourself struggling to keep up with the repayments on a 1300 mortgage for 30 years, it’s important to contact your lender immediately. They may be able to offer solutions such as a repayment holiday or adjusting the loan terms to help you manage your financial situation.

Q7. Is a 1300 mortgage for 30 years a fixed-rate or adjustable-rate mortgage?

- A 1300 mortgage for 30 years can be available as both a fixed-rate and an adjustable-rate mortgage. It depends on the lender and the specific terms of the mortgage.

Q8. What is the typical down payment required for a 1300 mortgage for 30 years?

- The down payment required for a 1300 mortgage for 30 years varies depending on the lender and your financial profile. Generally, a down payment of 5% to 20% of the property’s value is common.

Q9. Can self-employed individuals qualify for a 1300 mortgage for 30 years?

- Yes, self-employed individuals can qualify for a 1300 mortgage for 30 years. However, they may need to provide additional documentation, such as tax returns and financial statements, to demonstrate their income stability.

Q10. Can I use gifted funds for the down payment on a 1300 mortgage for 30 years?

- Yes, gifted funds can be used for the down payment on a 1300 mortgage for 30 years. However, lenders typically require a gift letter from the donor, stating that the funds are a gift and not a loan.

Q11. Are there any prepayment penalties associated with a 1300 mortgage for 30 years?

- Prepayment penalties vary among lenders. It’s crucial to review the terms of the mortgage agreement and discuss any potential prepayment penalties with your lender before signing the loan documents.

Q12. Can I switch from a 1300 mortgage for 30 years to a shorter loan term later?

- Yes, it is possible to refinance your mortgage and switch to a shorter loan term. However, the availability and terms of refinancing depend on the lender’s policies and your financial situation at the time of refinancing.

Q13. What is the minimum credit score required for a 1300 mortgage for 30 years?

- The minimum credit score required for a 1300 mortgage for 30 years varies among lenders. Generally, a credit score of 620 or above is considered favorable, but some lenders may have different requirements.

Q14. Can I qualify for a 1300 mortgage for 30 years with a high debt-to-income ratio?

- Lenders consider the debt-to-income ratio when assessing mortgage applications. While specific requirements vary, a lower debt-to-income ratio is generally more favorable for mortgage approval.

Q15. Are there any government-backed loan programs for a 1300 mortgage for 30 years?

- Yes, there are government-backed loan programs in the UK, such as the Help to Buy scheme, which can provide assistance and favorable terms for eligible borrowers looking to obtain a 1300 mortgage for 30 years.

Remember to consult with lenders or mortgage advisors to get personalized answers based on your unique financial situation and goals.

Conclusion

A 1300 mortgage for 30 years provides an attractive option for individuals and families looking to step onto the property ladder in the UK. With lower monthly repayments and increased affordability, it offers a pathway to homeownership. However, it’s crucial to understand and adhere to the UK mortgage rules to ensure eligibility and compliance. Consider the benefits and considerations associated with this mortgage option, including total interest paid and future financial goals. Additionally, be aware of the various government schemes and assistance programs available to support your homeownership journey.

Remember to carefully assess your financial situation and consult with lenders to determine the best course of action. With proper planning and consideration, a 1300 mortgage for 30 years can be a valuable tool to achieve your homeownership dreams.

Leave a Reply