“Looking to compare mortgages in the UK? Our comprehensive guide provides expert advice and insights to help you find the best mortgage deals. Explore different types of mortgages, factors to consider, FAQs, and more. Make an informed decision and secure the perfect mortgage for your needs. Start comparing mortgages today!”

When it comes to buying a home, one of the most important decisions you’ll face is choosing the right mortgage. With a multitude of options available in the market, finding the best mortgage deal can be a daunting task. In this article, we will explore the world of mortgages and provide you with a comprehensive guide to compare mortgages in the UK. Whether you’re a first-time buyer or looking to remortgage, this guide will equip you with the knowledge and tools to make an informed decision.

Compare Mortgages UK: Understanding Your Options

To begin our journey of finding the perfect mortgage, let’s start by understanding the different types of mortgages available in the UK market. By comparing the various options, you can identify which mortgage aligns with your financial goals and circumstances.

- Fixed-Rate Mortgages

A fixed-rate mortgage offers stability and predictability. With this type of mortgage, the interest rate remains the same throughout a fixed period, typically ranging from 2 to 10 years. By locking in a specific rate, you can budget and plan your finances accordingly.

- Tracker Mortgages

Tracker mortgages are linked to the Bank of England’s base rate or the lender’s standard variable rate (SVR). As the base rate fluctuates, your mortgage interest rate will also change. Tracker mortgages often offer an initial fixed-rate period before switching to a variable rate.

- Discounted Rate Mortgages

Discounted rate mortgages provide a discount on the lender’s SVR for a specified period. This means you pay a lower interest rate than the standard rate for a certain duration. However, it’s essential to carefully consider the terms and conditions of the deal to ensure it suits your long-term financial goals.

- Offset Mortgages

An offset mortgage allows you to use your savings to reduce the amount of interest you pay on your mortgage. By linking your savings and current accounts to your mortgage, the balances are offset against each other. This type of mortgage can help you save on interest payments over the term of the loan.

How to Compare Mortgages UK: Factors to Consider

Now that we have explored the different types of mortgages available, let’s dive deeper into the key factors you should consider when comparing mortgage deals in the UK. By evaluating these factors, you can make an informed decision that aligns with your financial goals and circumstances.

- Interest Rates

The interest rate is a crucial factor when comparing mortgages. Even a small difference in interest rates can have a significant impact on your monthly payments and the total amount you’ll repay over the mortgage term. It’s essential to compare interest rates from multiple lenders to ensure you’re getting the best deal.

- Fees and Charges

In addition to interest rates, it’s important to consider the fees and charges associated with each mortgage deal. These may include arrangement fees, valuation fees, legal fees, and early repayment charges. Take the time to understand the full cost of the mortgage and factor in these fees when comparing different options.

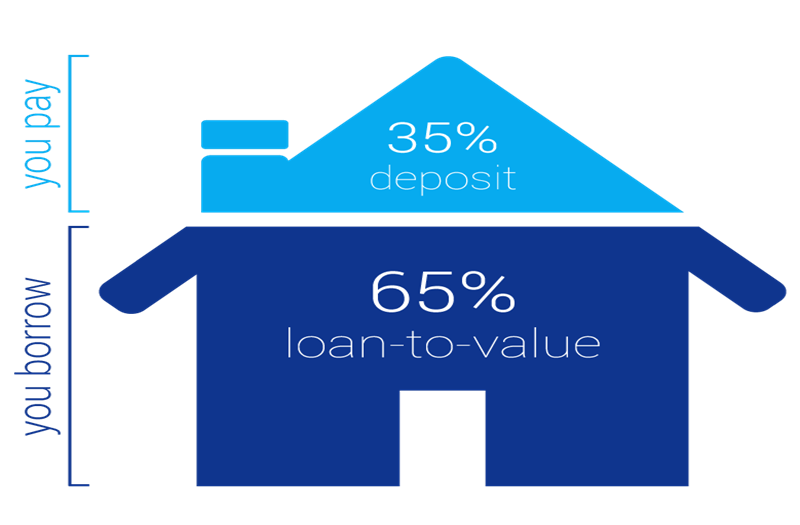

- Loan-to-Value (LTV) Ratio

The loan-to-value ratio represents the percentage of the property’s value that you can borrow. Lenders often offer better deals for lower LTV ratios, as they perceive these borrowers as less risky. It’s advisable to save for a larger deposit to secure a more favorable LTV ratio and access better mortgage rates.

- Repayment Options

Another important factor to consider is the repayment options available. The two primary repayment methods are repayment mortgages and interest-only mortgages. With a repayment mortgage, your monthly payments contribute to both the principal and interest, ensuring that the loan is fully repaid by the end of the term. On the other hand, interest-only mortgages require you to only pay the interest, with the principal repaid at the end of the term. Understanding the pros and cons of each option is crucial in making the right choice.

- Flexibility and Portability

Flexibility and portability are essential considerations, especially if you anticipate any changes in your circumstances in the future. Some mortgages offer features such as overpayments, underpayments, payment holidays, and the ability to transfer the mortgage to a new property. Assess your requirements and opt for a mortgage that provides the necessary flexibility and portability.

Frequently Asked Questions (FAQs)

Can I compare mortgages without affecting my credit score?

- Yes, you can compare mortgages without affecting your credit score. Using online mortgage comparison tools and calculators allows you to get an estimate of the rates and terms available to you without undergoing a formal credit check. However, keep in mind that when you formally apply for a mortgage, the lender will conduct a credit check, which can impact your credit score.

How do I find the best mortgage deals in the UK?

- To find the best mortgage deals in the UK, it’s recommended to consult with a mortgage broker who has access to a wide range of lenders and deals. They can provide personalized advice and help you navigate the complexities of the mortgage market. Additionally, utilizing online comparison tools and staying updated with the latest mortgage news can assist you in finding competitive deals.

What documents do I need to apply for a mortgage in the UK?

- When applying for a mortgage in the UK, you will typically need to provide documents such as proof of identity (passport, driver’s license), proof of address (utility bills, bank statements), proof of income (payslips, tax returns), and bank statements to verify your financial history. The specific documents required may vary depending on the lender and your individual circumstances.

How can I improve my chances of getting approved for a mortgage?

- To improve your chances of getting approved for a mortgage, there are several steps you can take. Firstly, ensure that you have a good credit score by making timely payments and managing your debts responsibly. Saving for a larger deposit can also increase your chances of approval and access to better rates. Finally, reducing your existing debts and avoiding any major financial commitments before applying for a mortgage can strengthen your application.

Is it possible to switch my mortgage to a different lender?

- Yes, it is possible to switch your mortgage to a different lender. This process is known as remortgaging. By remortgaging, you can take advantage of better interest rates or change the terms of your mortgage to suit your current circumstances. However, it’s crucial to consider any fees or charges associated with remortgaging and weigh them against the potential savings.

What happens if I can’t keep up with my mortgage payments?

- If you find yourself unable to keep up with your mortgage payments, it’s essential to contact your lender as soon as possible. They may be able to provide assistance or offer alternative solutions, such as a temporary payment holiday or restructuring the mortgage terms. Ignoring the issue can lead to more significant financial consequences, including the risk of repossession.

Is it better to choose a fixed-rate mortgage or a variable rate mortgage?

- The choice between a fixed-rate mortgage and a variable rate mortgage depends on your personal circumstances and preferences. A fixed-rate mortgage offers stability and protection against interest rate fluctuations, making it a popular choice for those who prefer predictable monthly payments. On the other hand, a variable rate mortgage can be beneficial if you believe interest rates may decrease in the future, as it offers the potential for lower payments. Consider your financial goals and tolerance for risk when making this decision.

What is a mortgage agreement in principle (AIP)?

- A mortgage agreement in principle, also known as a decision in principle or a mortgage promise, is a preliminary assessment by a lender that indicates how much they may be willing to lend you based on your financial information. It provides an estimate of your borrowing capacity and can help you understand your budget when searching for a property. However, it is important to note that an AIP is not a guarantee of a mortgage offer, as the lender will conduct a more thorough assessment before finalizing the loan.

Can I get a mortgage if I have bad credit?

- Having bad credit can make it more challenging to obtain a mortgage, but it is not impossible. Some lenders specialize in offering mortgages to individuals with adverse credit histories. However, the interest rates and terms may be less favorable compared to those offered to borrowers with good credit. It is advisable to work on improving your credit score before applying for a mortgage and consider seeking advice from a mortgage broker who can guide you to suitable lenders.

What is the difference between a repayment mortgage and an interest-only mortgage?

- A repayment mortgage involves making monthly payments that cover both the interest on the loan and the repayment of the principal amount borrowed. Over time, the outstanding balance decreases until the mortgage is fully repaid. In contrast, an interest-only mortgage requires you to pay only the interest each month, with the principal amount remaining unchanged. At the end of the term, you are responsible for repaying the principal in full. Repayment mortgages are generally more common and provide a clear path to full homeownership.

Can I use a mortgage to buy a property for investment purposes?

- Yes, it is possible to use a mortgage to buy a property for investment purposes. However, there are some key differences between mortgages for investment properties and those for primary residences. Lenders may have stricter eligibility criteria and require larger deposits for investment properties. Additionally, the interest rates and fees may differ from those for residential mortgages. It is crucial to carefully consider the financial implications and potential returns of an investment property before proceeding.

How long does the mortgage application process typically take?

- The mortgage application process can vary depending on several factors, including the lender, your circumstances, and the complexity of the application. On average, the process can take anywhere from a few weeks to a few months. It involves gathering necessary documents, completing an application form, undergoing a credit check, and having the property valuated. Working with a mortgage broker can help streamline the process and ensure a smoother experience.

What is a mortgage deposit, and how much do I need?

- A mortgage deposit is the initial amount of money you contribute towards the purchase of a property. It is typically expressed as a percentage of the property’s purchase price. The amount required for a deposit can vary depending on factors such as the lender, the type of mortgage, and your financial circumstances. Generally, a larger deposit is advantageous as it can lead to better interest rates and increase your chances of mortgage approval. Aim to save as much as possible to secure a favorable deposit amount.

What is the difference between a mortgage lender and a mortgage broker?

- A mortgage lender is a financial institution, such as a bank or building society, that provides mortgages directly to borrowers. They assess your eligibility, offer various mortgage products, and ultimately provide the funds for your home purchase. On the other hand, a mortgage broker acts as an intermediary between borrowers and lenders. They have access to multiple lenders and can help you find the most suitable mortgage deal based on your financial situation. Mortgage brokers offer personalized advice and guide you through the application process.

Can I pay off my mortgage early?

- Yes, it is generally possible to pay off your mortgage early. However, it’s important to review your mortgage agreement and check for any penalties or charges associated with early repayment. Some mortgages impose early repayment charges, especially during fixed-rate periods. If there are no penalties, you can make additional payments towards your mortgage principal or choose to increase your monthly payments. Paying off your mortgage early can save you money on interest payments and provide financial freedom sooner.

I hope these additional FAQs help provide further clarity on the topic of mortgages in the UK. If you have any more questions, feel free to ask!

Conclusion

Choosing the right mortgage is a significant decision that requires careful consideration. By comparing mortgage options in the UK based on interest rates, fees, repayment options, and other factors, you can find a mortgage that suits your needs and financial goals. Remember to seek professional advice from mortgage brokers and stay informed about the latest developments in the market. With the knowledge gained from this guide, you’ll be well-equipped to embark on your home-buying journey and secure the best mortgage deal for your circumstances.

Leave a Reply