“Compare mortgage options in the UK and find the perfect deal for your home. Our comprehensive guide helps you navigate interest rates, repayment options, and eligibility criteria. Make informed decisions with our expert advice.”

In the dynamic landscape of the UK housing market, finding the right mortgage can be a daunting task. With numerous lenders, varying interest rates, and a wide range of mortgage products available, it’s essential to compare your options carefully. In this article, we will guide you through the process of UK mortgage comparison, empowering you to make informed decisions and secure the most suitable mortgage for your needs.

Understanding Mortgages in the UK

A mortgage is a loan provided by a financial institution, typically a bank or building society, to help individuals purchase property. In the UK, mortgages come in various types, each with its own features and benefits. Before diving into the world of mortgage comparison, it’s crucial to have a solid understanding of these mortgage types and how they work.

Factors to Consider in Mortgage Comparison

When comparing mortgages, several factors should be taken into account:

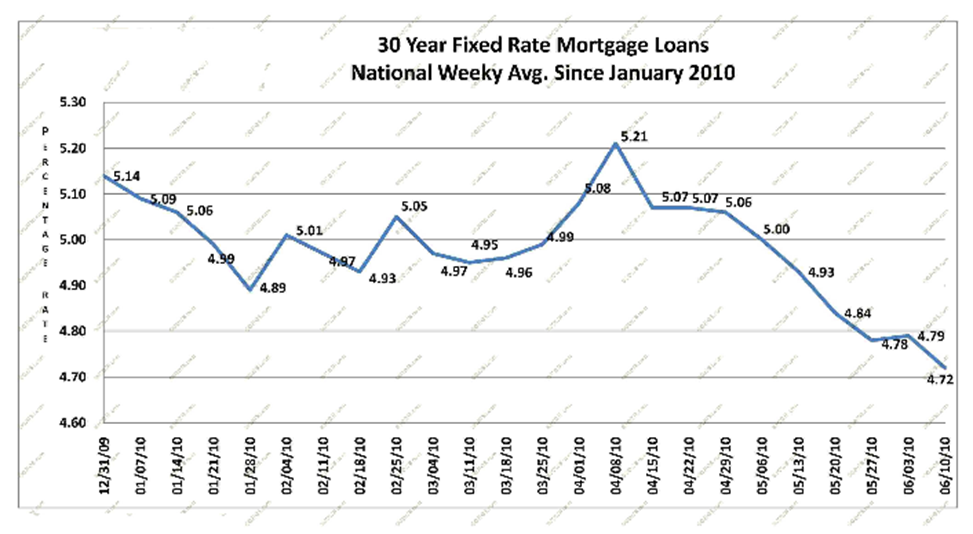

Interest rates: The interest rate determines the cost of borrowing and significantly impacts the total amount repaid over the mortgage term.

Repayment options: Consider whether you prefer a repayment mortgage, where you gradually pay off the principal and interest, or an interest-only mortgage, where you only pay the interest during the term.

Mortgage term: The length of the mortgage term affects monthly repayments and the total amount repaid.

Fees and charges: Evaluate any arrangement fees, valuation fees, or early repayment charges associated with the mortgage.

Flexibility: Some mortgages offer features like overpayments, underpayments, or payment holidays, providing flexibility in managing your mortgage.

Mortgage Types

- Fixed-Rate Mortgages

A fixed-rate mortgage offers stability and predictability. With this type of mortgage, the interest rate remains unchanged for a specified period, typically two to five years. This allows borrowers to budget effectively, knowing that their monthly payments won’t fluctuate with interest rate changes.

- Variable-Rate Mortgages

Unlike fixed-rate mortgages, variable-rate mortgages have interest rates that can change over time. These mortgages are influenced by the lender’s standard variable rate (SVR), which is often linked to the Bank of England’s base rate. Borrowers should be aware that their monthly payments can rise or fall based on market conditions.

- Tracker Mortgages

Tracker mortgages are a specific type of variable-rate mortgage. The interest rate on a tracker mortgage is directly linked to an external benchmark, usually the Bank of England’s base rate, plus an additional percentage. As the base rate fluctuates, the mortgage rate follows suit.

- Discount Mortgages

Discount mortgages offer a reduction or discount on the lender’s standard variable rate for a set period. While these mortgages provide lower initial rates, borrowers should carefully consider the potential increase in monthly payments once the discount period ends.

- Offset Mortgages

An offset mortgage allows borrowers to link their mortgage with their savings or current account. By offsetting the mortgage balance against the savings or current account balance, borrowers can reduce the interest charged on the mortgage. This type of mortgage can be beneficial for individuals with significant savings.

- Buy-to-Let Mortgages

Buy-to-let mortgages are designed for individuals purchasing property with the intention of renting it out. These mortgages differ from residential mortgages and often require a larger deposit. It’s crucial to carefully assess the potential rental income and associated costs before opting for a buy-to-let mortgage.

- Government-Supported Mortgages

The UK government offers several initiatives to support first-time buyers, including Help to Buy and shared ownership schemes. These schemes aim to assist individuals who may struggle to secure a mortgage by providing financial assistance and favorable terms.

- Mortgage Comparison Tools and Resources

Fortunately, several online tools and resources are available to aid in the mortgage comparison process. Websites and apps provide mortgage calculators, allowing you to input your financial details and explore various mortgage options. These tools can help you assess affordability, compare interest rates, and estimate monthly repayments.

Evaluating Lenders and Interest Rates

When comparing mortgages, it’s crucial to evaluate lenders and their interest rates carefully. Research lenders’ reputations, customer reviews, and their overall financial stability. Additionally, consider seeking professional advice from mortgage brokers who can offer personalized guidance based on your specific circumstances.

Considerations for First-Time Buyers

First-time buyers face unique challenges when entering the property market. It’s essential to consider factors such as affordability, eligibility criteria, and government support available. Taking advantage of schemes like Help to Buy or shared ownership can make homeownership more accessible for first-time buyers.

Mortgage Terms and Conditions

Before committing to a mortgage, thoroughly review the terms and conditions. Pay close attention to details such as early repayment penalties, restrictions on overpayments, and the mortgage’s portability if you plan to move house in the future. Understanding the terms and conditions ensures you are fully aware of your obligations as a borrower.

Affordability and Eligibility

Assessing affordability is a crucial step in the mortgage comparison process. Lenders typically evaluate income, expenses, credit history, and debt-to-income ratio when determining affordability. Use online affordability calculators to estimate how much you can borrow and comfortably repay based on your financial situation.

Making an Informed Decision

After carefully considering all the relevant factors, you are ready to make an informed decision. Select a mortgage that aligns with your financial goals, offers favorable terms, and provides the flexibility you require. Remember, it’s crucial to seek professional advice and compare multiple offers before finalizing your mortgage choice.

Conclusion

Comparing mortgages in the UK is a vital step towards securing the right mortgage for your needs. By understanding the different mortgage types, considering key factors, and utilizing online tools, you can make informed decisions and navigate the complex world of mortgages. Take your time, evaluate your options, and seek professional guidance when necessary. With the right mortgage in place, you’ll be one step closer to achieving your homeownership dreams.

FAQs (Frequently Asked Questions)

Is it better to choose a fixed-rate or variable-rate mortgage?

- The choice between fixed-rate and variable-rate mortgages depends on your risk tolerance and financial goals. Fixed-rate mortgages offer stability, while variable-rate mortgages can provide potential savings if interest rates decrease.

What is the minimum deposit required for a mortgage in the UK?

- The minimum deposit required varies depending on the lender and the mortgage product. In general, a higher deposit percentage can lead to better interest rates and increased chances of mortgage approval.

How long does the mortgage application process take?

- The mortgage application process can take several weeks. Factors such as the lender’s efficiency, document preparation, and property valuation can affect the duration.

Can I overpay on my mortgage?

- Yes, many mortgage agreements allow borrowers to make overpayments on their mortgage. Overpaying on your mortgage can offer several benefits;

- Reduced interest costs

- Shortened mortgage term

- Increased equity

What is a mortgage agreement in principle (AIP)?

- A mortgage agreement in principle, also known as a decision in principle or a mortgage promise, is a preliminary assessment by a lender. It provides an indication of how much they may be willing to lend you based on your financial information. It helps you understand your affordability and demonstrates your seriousness to potential sellers.

Can I switch my mortgage to another lender?

- Yes, it is possible to switch your mortgage to another lender. This process is known as remortgaging. However, it is important to carefully consider the costs, including any early repayment charges with your current lender, as well as the potential benefits of switching to a new lender.

What is a mortgage broker, and should I use one?

- A mortgage broker is a professional who acts as an intermediary between borrowers and lenders. They can help you navigate the mortgage market, compare different lenders and products, and provide personalized advice. Using a mortgage broker can save you time, offer access to exclusive deals, and increase your chances of finding the most suitable mortgage.

How do interest rates affect my monthly mortgage payments?

- Interest rates directly impact your monthly mortgage payments. When interest rates rise, your payments may increase, while a decrease in interest rates can result in lower payments. It is essential to consider the potential impact of interest rate fluctuations when comparing mortgage options.

What is a mortgage term?

- The mortgage term refers to the length of time over which you agree to repay your mortgage. It is typically expressed in years. Choosing a shorter mortgage term will result in higher monthly payments but can save you money on interest over the long term. A longer term will have lower monthly payments but may result in more interest paid overall.

What is a standard variable rate (SVR)?

- The standard variable rate (SVR) is the interest rate set by a lender, which can vary at their discretion. It is often influenced by the Bank of England’s base rate. Borrowers who are on an SVR mortgage should be aware that their monthly payments can change, as the rate may fluctuate in response to market conditions.

What is a mortgage deposit?

- A mortgage deposit is the initial amount of money you contribute towards the purchase of a property. The deposit is usually expressed as a percentage of the property’s value. A higher deposit can lead to better interest rates and a wider choice of mortgage options.

Can I get a mortgage with bad credit?

- It can be more challenging to secure a mortgage with bad credit, but it is not impossible. Some specialist lenders offer mortgages for individuals with adverse credit histories. However, the interest rates may be higher, and the loan-to-value ratio may be lower. Consulting with a mortgage advisor can provide insights into available options.

What is a mortgage affordability assessment?

- A mortgage affordability assessment is an evaluation of your financial circumstances to determine how much you can afford to borrow. Lenders assess factors such as your income, expenses, credit history, and debt-to-income ratio to determine your affordability. This assessment helps lenders ensure that you can comfortably repay the mortgage.

What is a mortgage offer?

- A mortgage offer is a formal confirmation from a lender that they are willing to lend you a specific amount of money for a mortgage. It outlines the terms and conditions of the loan, including the interest rate, mortgage term, and any special conditions. A mortgage offer provides certainty and allows you to proceed with the property purchase.

What are the costs associated with getting a mortgage?

- There are several costs associated with getting a mortgage, including arrangement fees, valuation fees, legal fees, and stamp duty (a tax on property purchases above a certain threshold). It is important to factor in these costs when considering the overall affordability of a mortgage.