Learn the key factors and requirements for qualifying for a mortgage in the UK. Understand credit scores, income stability, debt-to-income ratio, and more. Discover essential documents, the mortgage pre-approval process, and tips for a successful mortgage application. Start your journey toward homeownership today.

Introduction:

Qualifying for a mortgage in the UK is a crucial step toward achieving your dream of owning a home. In this comprehensive guide, we will explore the key factors and requirements necessary to secure a mortgage. From credit scores to income stability, debt-to-income ratios to savings deposits, we’ll cover everything you need to know to increase your chances of mortgage approval.

Understanding Mortgage Qualification:

A. Credit Score and History

- The Significance of Credit Scores for Mortgage Approval

- Exploring the impact of credit scores on mortgage eligibility

- How lenders assess creditworthiness based on credit history

- Tips to Improve Your Credit Score

- Understanding credit scoring factors

- Practical steps to boost your credit score before applying for a mortgage

- The Importance of Maintaining a Good Credit History

- Explaining the benefits of a positive credit history

- How to maintain good credit habits for long-term mortgage success

B. Income and Employment

- Assessing Income and Employment Stability

- Understanding how lenders evaluate income and employment status

- Documentation and verification requirements for income assessment

- Minimum Income Requirements for Mortgage Approval

- Providing insights into the income thresholds set by lenders

- Strategies for meeting or exceeding minimum income requirements

- Impact of Self-Employment on Mortgage Qualification

- Discussing the unique challenges and considerations for self-employed individuals

- Tips for demonstrating income stability and increasing mortgage eligibility

C. Debt-to-Income Ratio

- Defining and Explaining Debt-to-Income Ratio

- Understanding the significance of debt-to-income ratio in mortgage assessment

- Calculating your own debt-to-income ratio

- Acceptable Range for Mortgage Qualification

- Discovering the ideal debt-to-income ratio range for mortgage approval

- Managing existing debts and improving your ratio

- Strategies to Lower Debt and Improve the Ratio

- Practical tips for reducing debt burden and improving your financial health

- Long-term strategies to achieve a healthier debt-to-income ratio

D. Deposit and Savings

- Understanding the Concept of a Mortgage Deposit

- Explaining the purpose and importance of a mortgage deposit

- Differentiating between minimum and optimal deposit amounts

- Minimum Deposit Required for Mortgage Approval

- Highlighting the typical minimum deposit percentage set by lenders

- Strategies for saving and accumulating the required deposit amount

- Tips on Saving for a Mortgage Deposit

- Practical savings tips and budgeting techniques to help you reach your deposit goal

- Exploring government schemes and initiatives that support saving for a deposit

Mortgage Affordability:

A. Introduction to Mortgage Affordability

- Importance of Determining Affordability Before Applying

- Understanding the significance of affordability assessments in the mortgage process

- The impact of overextending yourself financially and how to avoid it

- Calculating Mortgage Affordability

- Exploring the key factors used to assess mortgage affordability

- Utilizing online affordability calculators to estimate your borrowing capacity

B. Affordability Assessment

- Criteria Used by Lenders to Assess Affordability

- Detailed explanation of the factors considered in mortgage affordability assessments

- Evaluating your financial situation from a lender’s perspective

- Factors Influencing Mortgage Affordability

- Discussing the variables that impact your mortgage affordability, such as income, debts, and living expenses

- Understanding how changes in interest rates and mortgage terms affect affordability

- Tips to Increase Mortgage Affordability

- Practical strategies for improving your financial position to afford a larger mortgage

- Exploring options to decrease expenses and increase income for better affordability

C. Affordability Tools and Calculators

- Introduction to Various Online Tools and Calculators

- Recommending reliable tools and calculators to assess your mortgage affordability

- Overview of their features and benefits for accurate calculations

- How to Effectively Use Affordability Tools and Calculators

- Step-by-step guide on using online tools to evaluate your borrowing capacity

- Interpreting the results and making informed decisions based on the calculated affordability

Documentation and Paperwork:

A. Required Documents

- Essential Documents for Mortgage Applications

- Comprehensive list of documents lenders typically require during the application process

- Importance of gathering and organizing these documents in advance

- Accurate and Up-to-Date Documentation

- Explaining the significance of providing accurate and current documentation

- Tips for ensuring the authenticity and completeness of your paperwork

B. Employment and Income Verification

- Verification Process for Employment and Income

- Overview of how lenders verify your employment and income details

- Document requirements and the role of employer verification

- Organizing and Presenting Relevant Documents

- Best practices for compiling and presenting employment and income-related documents

- Tips to streamline the verification process and avoid delays

C. Other Documentation Requirements

- Additional Documents Required for Mortgage Applications

- Discussing additional paperwork that may be requested during the mortgage process, such as proof of address or identification

- Importance of being prepared with all necessary documentation

- Overcoming Potential Documentation Challenges

- Addressing common hurdles that borrowers may encounter during the documentation stage

- Strategies for resolving issues and ensuring a smooth application process

IV. Mortgage Pre-Approval

A. Importance of Mortgage Pre-Approval

- Benefits of Obtaining a Mortgage Pre-Approval

- Exploring the advantages of securing a pre-approval before house hunting

- How pre-approval enhances your credibility and negotiating power

- How Pre-Approval Helps in the Home Buying Process

- Step-by-step explanation of how the pre-approval process aligns with your home search

- Understanding the limitations and validity period of pre-approvals

B. Steps to Get Pre-Approved

Step-by-Step Guide to Obtaining Mortgage Pre-Approval

- Detailed walkthrough of the pre-approval process, from application to decision

- Common requirements and potential challenges to anticipate

Criteria and Factors Considered During Pre-Approval

- Insight into the key factors lenders evaluate during the pre-approval assessment

- Tips for positioning yourself favorably and maximizing your pre-approval amount

Mortgage Application Process:

A. Finding a Suitable Lender

- Tips for Selecting the Right Lender for Your Mortgage

- Factors to consider when choosing a lender, including interest rates, terms, and customer service

- The importance of comparing offers and seeking professional advice

- Comparing Rates and Terms

- Explaining how variations in rates and terms impact your overall mortgage affordability

- Methods for effectively comparing and evaluating lender options

B. Completing the Application

- Mortgage Application Process

- Comprehensive overview of the steps involved in completing a mortgage application

- Understanding the information required and the timelines involved

- Filling out the Application Accurately

- Detailed guidance on completing the mortgage application accurately and efficiently

- Tips for avoiding common errors and ensuring all information is provided as requested

C. Working with a Mortgage Broker

- Benefits of Using a Mortgage Broker

- Exploring the advantages of working with a mortgage broker during the application process

- How brokers can help find the best mortgage options tailored to your needs

- Finding and Working with a Mortgage Broker

- Tips for finding a reputable and experienced mortgage broker in the UK

- Understanding the broker’s role in the application process and maintaining effective communication

Mortgage Approval and Closing

A. Mortgage Approval Process

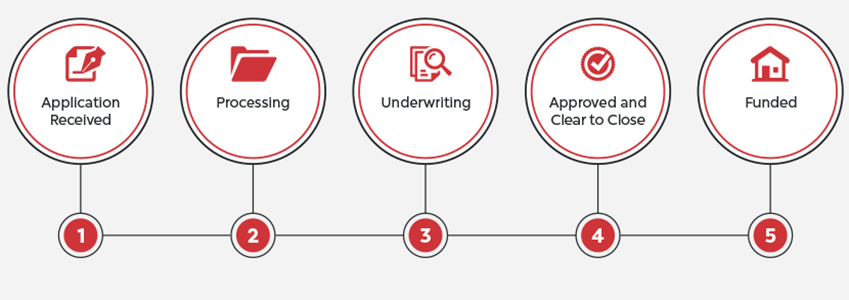

- Steps Involved in the Mortgage Approval Process

- Explaining the stages of mortgage approval, from application submission to final decision

- What happens during the underwriting and assessment process

- Overcoming Potential Challenges

- Addressing common challenges that borrowers may encounter during the approval process

- Strategies for resolving issues and increasing the chances of approval

B. Mortgage Closing

- Final Steps of the Mortgage Process

- Understanding the closing stage and what it entails

- Reviewing the required documentation and signing the mortgage agreement

- What to Expect at the Closing Stage

- A breakdown of the closing process and the parties involved

- Preparation tips to ensure a smooth and successful closing

In conclusion, qualifying for a mortgage in the UK is a significant milestone on the path to homeownership. It requires careful attention to various factors, including credit scores, income stability, debt-to-income ratio, and savings deposits. By understanding these key requirements and taking proactive steps to improve your financial profile, you can increase your chances of securing a mortgage.

Qualifying for a mortgage in the UK requires careful consideration of various factors such as credit scores, income stability, debt-to-income ratio, and savings. By understanding the requirements, gathering necessary documentation, and seeking professional guidance when needed, you can increase your chances of securing a mortgage and fulfilling your dream of homeownership.

- What credit score is needed to qualify for a mortgage in the UK?

- Answer: While credit score requirements vary, a higher credit score generally improves your chances. Lenders typically look for a score of 620 or above.

- How can I improve my credit score before applying for a mortgage?

- Answer: Focus on paying bills on time, reducing credit card balances, and avoiding new debt. Regularly checking your credit report for errors is also recommended.

- What documents are required for a mortgage application?

- Answer: Commonly required documents include proof of income, bank statements, identification documents, and details of existing debts. Your lender will provide a specific checklist.

- What is a debt-to-income ratio, and how does it affect mortgage qualification?

- Answer: The debt-to-income ratio compares your monthly debt payments to your gross income. Lenders typically prefer ratios below 43% for mortgage approval.

- Can self-employed individuals qualify for a mortgage?

- Answer: Yes, self-employed individuals can qualify for a mortgage. However, they may need to provide additional documentation to demonstrate income stability.

- Is mortgage pre-approval necessary?

- Answer: Mortgage pre-approval is not mandatory, but it offers significant advantages. It gives you a clearer picture of your budget, strengthens your offer, and saves time during the home buying process.

- How do I find the right lender for my mortgage?

- Answer: Research different lenders, compare interest rates and terms, read customer reviews, and consider seeking recommendations from trusted sources.

- What happens during the mortgage closing process?

- Answer: During closing, you’ll review and sign the final loan documents, pay closing costs, and receive the keys to your new home.

- How long does the mortgage approval process take?

- Answer: The mortgage approval process can vary depending on factors such as the lender’s workload, the complexity of your application, and the efficiency of document submission. It typically takes around 30 to 45 days, but it can be shorter or longer.

- What should I expect at the mortgage closing?

- Answer: At the closing, you’ll review and sign the final loan documents, including the mortgage agreement and other necessary paperwork. You’ll also pay any remaining closing costs, and the property ownership will be transferred to you.

Leave a Reply