Are you a UK mortgage applicant looking for information on when 5 mortgages will be back? This comprehensive guide has everything you need to know, from important tips to FAQs. Find out what 5 mortgages are, why they are currently unavailable, and when you might see them return. We also provide tips on how to prepare for when 5 mortgages become available again.

The UK mortgage market has been in a state of flux for the past few years. The availability of 5 mortgages has been particularly affected, with many lenders withdrawing these products from the market. This has left many potential homebuyers wondering when 5 mortgages will be back.

In this guide, we will take a look at the current state of the mortgage market, explain what 5 mortgages are and why they are popular, and discuss when we might see them return. We will also provide some important tips for preparing for when 5 mortgages become available again.

What are 5 mortgages?

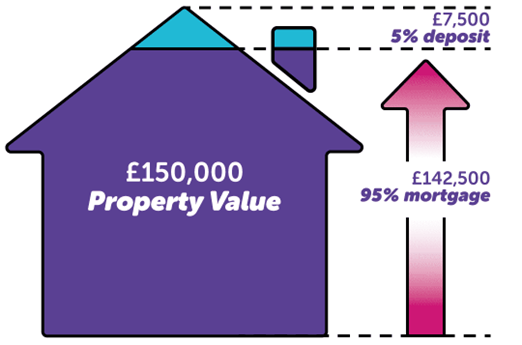

- A 5 mortgage is a type of mortgage that allows borrowers to borrow more than 95% of the value of the property they are buying. This means that borrowers can put down a deposit of less than 5%, which can be a significant saving for first-time buyers and those with limited savings.

- 5 mortgages are popular because they make it easier for people to buy a home. However, they are also riskier for lenders, as there is a greater chance that borrowers will default on their loans. This is why many lenders have withdrawn these products from the market.

Why are 5 mortgages currently unavailable?

There are a number of reasons why 5 mortgages are currently unavailable in the UK. These include:

- The rising cost of housing. The average house price in the UK has increased by over 20% in the past five years. This has made it more difficult for people to save for a deposit, and has led to an increase in the demand for 5 mortgages.

- The risk of default. As mentioned above, 5 mortgages are riskier for lenders than other types of mortgages. This is because there is a greater chance that borrowers will default on their loans if they have a low deposit.

- The financial crisis. The financial crisis of 2008 led to a number of lenders withdrawing 5 mortgages from the market. This was due to the high levels of default that were seen during this period.

When will 5 mortgages be back?

It is difficult to say when 5 mortgages will be back in the UK. However, there are a number of factors that could lead to their return, including:

- A fall in the cost of housing. If house prices fall, it will become easier for people to save for a deposit, which could lead to an increase in the demand for 5 mortgages.

- A change in lending criteria. Lenders may change their lending criteria to make it easier for people to obtain 5 mortgages. This could be done by reducing the minimum deposit required, or by offering lower interest rates.

- Government intervention. The government could intervene to encourage lenders to offer 5 mortgages. This could be done by providing guarantees to lenders, or by offering tax breaks to borrowers.

Will the return of 5 mortgages be affected by Brexit?

- The UK’s exit from the European Union (Brexit) could have an impact on the availability of 5 mortgages. This is because Brexit could lead to changes in the UK’s financial regulations, which could make it more difficult for lenders to offer these products.

- However, it is also possible that Brexit could lead to a fall in the cost of housing, which could make it easier for people to save for a deposit. This could lead to an increase in the demand for 5 mortgages, even if the UK’s financial regulations become more restrictive.

What are the benefits of a 5 mortgage?

There are a number of benefits to having a 5 mortgage. These include:

- Lower monthly payments. Borrowers with a 5 mortgage can often afford to pay lower monthly payments than borrowers with a traditional mortgage. This is because the lender is taking on more risk, so they are willing to offer a lower interest rate.

- Access to a wider range of properties. Borrowers with a 5 mortgage may be able to access a wider range of properties than borrowers with a traditional mortgage. This is because 5 mortgages are not restricted to properties that are below a certain price.

- The ability to buy a home sooner. Borrowers with a 5 mortgage may be able to buy a home sooner than borrowers with a traditional mortgage. This is because they do not need to save for a large deposit.

How can I prepare for when 5 mortgages become available again?

If you are hoping to get a 5 mortgage when they become available again, there are a number of things you can do to prepare. These include:

- Improve your credit score. A good credit score will make you more attractive to lenders, and could lead to you being offered a lower interest rate. You can improve your credit score by paying your bills on time, keeping your credit utilization low, and disputing any errors on your credit report.

- Save for a down payment. Even if you are able to get a 5 mortgage, it is still a good idea to save for a down payment. This will lower your monthly payments and make you less likely to default on your loan.

- Research lenders and mortgage options. There are many different lenders and mortgage options available. It is important to compare rates and fees before you choose a mortgage. You can use a mortgage calculator to estimate your monthly payments and total interest costs.

5 mortgages can be a good option for some people, but they are not right for everyone. If you are considering getting a 5 mortgage, it is important to weigh the risks and benefits carefully. You should also make sure that you are prepared to make the monthly payments and that you have a plan in case of unexpected expenses.

Here are some frequently asked questions about 5 mortgages:

1. What is the minimum deposit required for a 5 mortgage?

The minimum deposit required for a 5 mortgage varies depending on the lender and the property. However, most lenders require a minimum deposit of 5%.

2. What are the interest rates on 5 mortgages?

The interest rates on 5 mortgages are typically higher than the interest rates on traditional mortgages. This is because 5 mortgages are riskier for lenders.

3. What are the fees associated with 5 mortgages?

There are a number of fees associated with 5 mortgages, including application fees, valuation fees, and legal fees.

4. What are the risks of getting a 5 mortgage?

There are a number of risks associated with getting a 5 mortgage, including:

- The risk of default. If you default on your mortgage, you could lose your home.

- The risk of rising interest rates. If interest rates rise, your monthly payments could increase.

- The risk of negative equity. If the value of your property falls, you could end up owing more money than your property is worth.

5. What are the different types of 5 mortgages?

There are two main types of 5 mortgages:

- Conventional 5 mortgages: These mortgages are insured by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). This means that the lender is not required to make a down payment, and the borrower’s credit score is not as important.

- Non-conventional 5 mortgages: These mortgages are not insured by the FHA or the VA. This means that the lender requires a down payment, and the borrower’s credit score is more important.

6. What are the advantages of getting a 5 mortgage?

There are several advantages to getting a 5 mortgage, including:

- Lower monthly payments: Borrowers with a 5 mortgage can often afford to pay lower monthly payments than borrowers with a traditional mortgage. This is because the lender is taking on more risk, so they are willing to offer a lower interest rate.

- Access to a wider range of properties: Borrowers with a 5 mortgage may be able to access a wider range of properties than borrowers with a traditional mortgage. This is because 5 mortgages are not restricted to properties that are below a certain price.

- The ability to buy a home sooner: Borrowers with a 5 mortgage may be able to buy a home sooner than borrowers with a traditional mortgage. This is because they do not need to save for a large deposit.

7. What are the disadvantages of getting a 5 mortgage?

There are also some disadvantages to getting a 5 mortgage, including:

- Higher interest rates: The interest rates on 5 mortgages are typically higher than the interest rates on traditional mortgages. This is because 5 mortgages are riskier for lenders.

- More fees: There are more fees associated with 5 mortgages than traditional mortgages.

- Less flexibility: 5 mortgages typically have less flexibility than traditional mortgages. For example, borrowers may not be able to refinance their loans as easily, or they may have to pay prepayment penalties if they want to pay off their loans early.

8. What are the different ways to qualify for a 5 mortgage?

There are several ways to qualify for a 5 mortgage, including:

- Have a good credit score: Lenders typically require a credit score of at least 620 to qualify for a 5 mortgage.

- Make a down payment: The amount of the down payment required will vary depending on the lender and the type of 5 mortgage.

- Have a steady income: Lenders want to see that you have a steady income that will be able to cover your monthly mortgage payments.

- Be able to afford the monthly payments: Lenders will want to see that you can afford the monthly mortgage payments, including principal, interest, taxes, and insurance.

9. What are the steps involved in getting a 5 mortgage?

The steps involved in getting a 5 mortgage vary depending on the lender. However, the general process includes:

- Get pre-approved for a mortgage: This will give you an idea of how much you can borrow and what your monthly payments will be.

- Find a property: Once you have been pre-approved for a mortgage, you can start looking for a property.

- Make an offer on the property: Once you have found a property that you want to buy, you will need to make an offer to the seller.

- Get a home inspection: A home inspection is a good idea to make sure that there are no major problems with the property.

- Close on the property: Once the home inspection is complete and the seller has accepted your offer, you will need to close on the property. This is when you will sign all of the paperwork and take possession of the property.

10. What are some resources that can help me learn more about 5 mortgages?

There are a number of resources that can help you learn more about 5 mortgages, including:

- Your lender: Your lender can provide you with more information about 5 mortgages and how to qualify for one.

- The Federal Housing Administration (FHA): The FHA offers a number of resources for borrowers, including a website with information about 5 mortgages.

- The Department of Veterans Affairs (VA): The VA also offers a number of resources for borrowers, including a website with information about 5 mortgages.

Leave a Reply