Discover how to calculate a UK mortgage payment accurately. This article provides step-by-step instructions, formulas, and tools to help you understand the components of a mortgage payment, create an amortization schedule, make additional payments, and utilize mortgage payment calculators. Learn how interest rates, loan terms, and principal amounts impact your monthly payments, and gain valuable insights to navigate the mortgage process effectively.

Outline

Introduction

Understanding Mortgage Payments

- What is a mortgage payment?

- Components of a mortgage payment

Calculation Methods

- Formula for calculating mortgage payments

- Example calculation

Factors Affecting Mortgage Payments

- Interest rate

- Loan term

- Principal amount

Amortization Schedule

- Definition and purpose

- How to create an amortization schedule

Impact of Additional Payments

- Benefits of making extra payments

- How additional payments affect mortgage payments

Mortgage Payment Calculators

- Online tools for mortgage payment calculations

- Benefits of using mortgage calculators

Conclusion

FAQs

Introduction

Purchasing a home is an important milestone in anyone’s life, and for many, it requires taking out a mortgage. Understanding how mortgage payments are calculated is crucial when considering homeownership in the UK. This article will guide you through the process of calculating a UK mortgage payment, allowing you to make informed decisions and plan your finances effectively.

Understanding Mortgage Payments

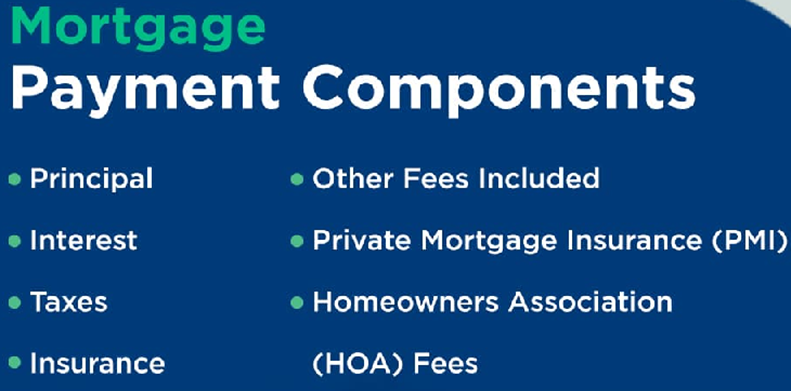

Before delving into the calculations, let’s first clarify what a mortgage payment entails. A mortgage payment is a regular installment made by the borrower to repay the borrowed funds and associated interest over a specific period, typically in monthly installments. It includes various components that contribute to the overall payment amount.

Calculation Methods

To calculate a UK mortgage payment, you can use a formula that takes into account the principal amount, interest rate, and loan term. The most common formula is the monthly payment formula, which considers these factors to determine the amount owed each month.

Let’s break down the formula step by step. The monthly mortgage payment (PMT) can be calculated using the following equation:

Where:

Example Calculation

Suppose you have taken out a mortgage of £200,000 with an annual interest rate of 3.5%. The loan term is 25 years, which amounts to 300 monthly payments.

Using the formula mentioned earlier, we can calculate the monthly mortgage payment as follows:

By performing the calculations, we find that the monthly mortgage payment would be approximately £988.88.

Factors Affecting Mortgage Payments

- Several factors can influence the amount of your mortgage payment. Understanding these factors is essential to comprehend how payments may vary.

- The interest rate plays a significant role. A higher interest rate will result in a higher monthly payment, as more interest needs to be paid on the borrowed amount.

- The loan term is another important consideration. Shorter loan terms lead to higher monthly payments but result in lower overall interest payments over the life of the loan.

- The principal amount borrowed also affects mortgage payments. A larger principal amount will typically lead to higher monthly payments.

Amortization Schedule

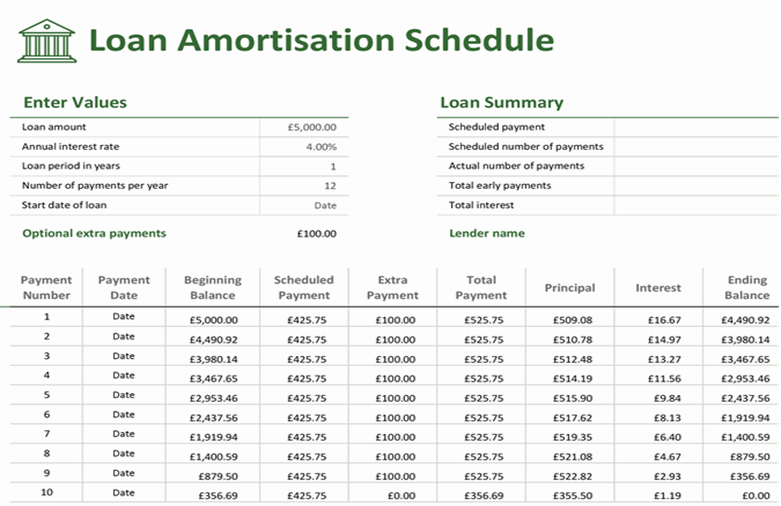

An amortization schedule is a useful tool that outlines the payment structure of a mortgage over its lifespan. It provides a detailed breakdown of each payment, showing the portion allocated to principal repayment and interest payment. Creating an amortization schedule allows borrowers to track their progress in paying off the loan and understand how each payment contributes to reducing the overall balance.

To create an amortization schedule, follow these steps:

- Start with the initial loan amount (principal), the interest rate, and the loan term in years.

- Convert the annual interest rate to a monthly rate by dividing it by 12.

- Determine the total number of payments by multiplying the loan term (in years) by 12.

- Use the monthly payment formula mentioned earlier to calculate the fixed monthly payment amount.

- Begin with the first payment and allocate a portion towards interest payment based on the outstanding balance and the monthly interest rate.

- Subtract the interest payment from the total monthly payment to determine the amount applied to principal repayment.

- Subtract the principal repayment from the outstanding balance to get the new balance for the next month.

- Repeat the process for each subsequent payment, adjusting the interest payment and principal repayment accordingly.

- Continue until the final payment is made, resulting in a balance of zero.

- By following this method, you can create an amortization schedule that illustrates the progression of your mortgage payments over time, including the changing proportions of principal and interest.

Impact of Additional Payments

Making additional payments towards your mortgage can have significant benefits. By paying more than the required monthly payment, you can reduce the principal balance faster, which, in turn, reduces the overall interest paid over the life of the loan. This can result in substantial savings and an earlier payoff date.

- When you make extra payments, the additional amount is applied directly to the principal balance. As a result, the outstanding balance decreases, which can lead to lower future interest charges. Additionally, making additional payments can help build home equity at a faster rate.

- It’s essential to communicate with your mortgage lender to understand their policies regarding extra payments. Some lenders may have specific instructions on how to apply additional funds, while others may have restrictions or penalties for prepayments. Understanding these terms will help you make the most effective use of your extra payments.

Mortgage Payment Calculators

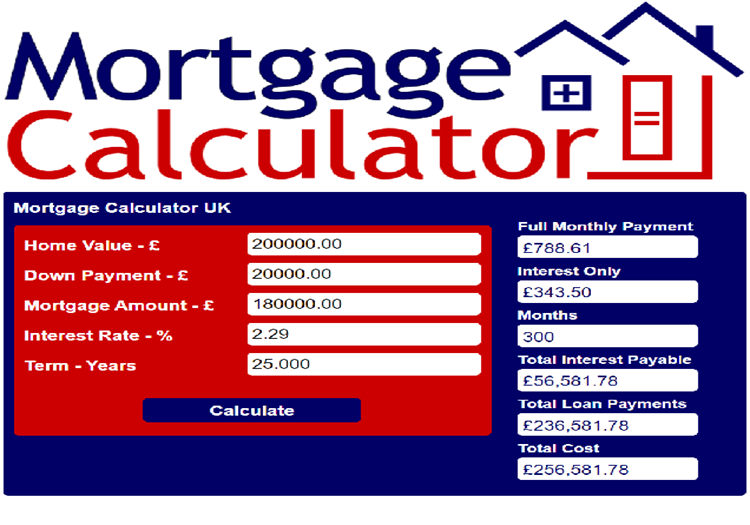

Calculating mortgage payments manually can be time-consuming, especially when considering different loan terms and interest rates. Thankfully, there are various online tools and mortgage payment calculators available to simplify the process.

- Mortgage payment calculators allow you to input relevant information such as loan amount, interest rate, loan term, and any additional payments. With just a few clicks, these calculators can provide you with accurate monthly payment amounts and even generate amortization schedules. They save time and offer convenience, enabling you to explore different scenarios and make informed decisions about your mortgage.

- Using mortgage payment calculators is especially helpful when comparing different loan options or considering refinancing. By adjusting the variables, you can quickly assess how changes in interest rates, loan terms, or additional payments affect your monthly payments and overall mortgage cost.

Frequently Asked Questions (FAQ’s)

Q.1. How can I calculate my UK mortgage payment?

- To calculate your UK mortgage payment, you can use the formula: PMT = (P * r * (1 + r)^n) / ((1 + r)^n – 1), where P is the principal amount, r is the monthly interest rate, and n is the total number of payments.

Q.2. What components make up a mortgage payment?

- A mortgage payment typically consists of principal repayment, interest payment, and, in some cases, additional costs like property taxes and insurance.

Q.3. How does the interest rate affect mortgage payments?

- A higher interest rate leads to higher monthly mortgage payments, as more interest needs to be paid on the borrowed amount.

Q.4. What is an amortization schedule?

- An amortization schedule is a table that shows the breakdown of each mortgage payment, indicating the portion allocated to principal repayment and interest payment over time.

Q.5. How can I create an amortization schedule?

- You can create an amortization schedule by using the loan amount, interest rate, loan term, and the formula for calculating mortgage payments. It helps you track your progress in repaying the loan.

Q.6. What are the benefits of making additional payments towards my mortgage?

- Making extra payments can help you pay off your mortgage faster and save on overall interest payments, leading to substantial savings over time.

Q.7. How do additional payments affect mortgage payments?

- Additional payments directly reduce the principal balance, resulting in lower future interest charges and potentially shorter loan terms.

Q.8. Are there any penalties for making extra payments on a mortgage?

- It’s important to consult your mortgage lender regarding their policies on extra payments. Some lenders may have specific instructions or penalties for prepayments.

Q.9. Can I use online tools to calculate my mortgage payment?

- Yes, there are various online mortgage payment calculators available that can help you determine your monthly payment amount based on the loan details you provide.

Q.10. What are the advantages of using mortgage payment calculators?

- Mortgage payment calculators offer convenience and allow you to explore different scenarios by adjusting variables such as loan amount, interest rate, and loan term. They help you make informed decisions and compare options.

Q.11. Can I reduce my mortgage payment by refinancing?

- Refinancing your mortgage can potentially lead to lower monthly payments if you secure a new loan with a lower interest rate or extend the loan term.

Q.12. What is the impact of a shorter loan term on mortgage payments?

- Choosing a shorter loan term results in higher monthly payments but can save you money on overall interest payments over the life of the loan.

Q.13. Does the size of the principal amount affect mortgage payments?

- Yes, a larger principal amount generally leads to higher monthly mortgage payments.

Q.14. How often are mortgage payments made in the UK?

- Mortgage payments in the UK are typically made on a monthly basis.

Q.15. Is it possible to calculate mortgage payments manually without using formulas or calculators?

- While it is possible to calculate mortgage payments manually, it can be time-consuming, and using formulas or calculators offers a more efficient and accurate approach.

Conclusion

Calculating a UK mortgage payment is essential for understanding the financial commitment of homeownership. By comprehending the components of a mortgage payment and utilizing calculation methods, borrowers can accurately determine their monthly obligations. Amortization schedules help visualize the payment structure, while additional payments and mortgage calculators provide flexibility and convenience in managing the loan.

By familiarizing yourself with these concepts and tools, you can navigate the mortgage process with confidence, make informed financial decisions, and work towards the goal of homeownership or effectively managing your existing mortgage.

Leave a Reply