“Discover the ins and outs of Buy to Let Mortgages in our comprehensive guide. Learn about the benefits, types, application process, and FAQs surrounding property investment. Make informed decisions and maximize your returns with expert insights and advice.”

Welcome to our comprehensive guide on Buy to Let Mortgages, an essential tool for property investors looking to generate income through rental properties. In this article, we will explore the ins and outs of Buy to Let Mortgages, providing you with expert insights and valuable information to help you navigate the world of property investment with confidence.

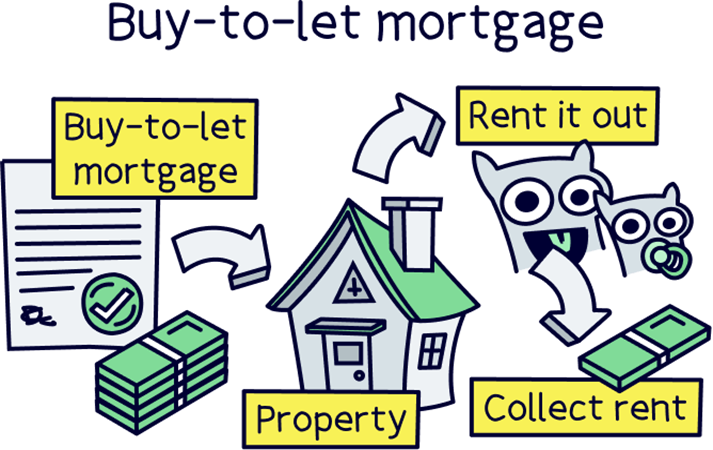

What are Buy to Let Mortgages?

Buy to Let Mortgages are financial products specifically designed for individuals who wish to purchase residential properties with the intention of letting them out to tenants. Unlike residential mortgages, which are intended for personal use, Buy to Let Mortgages cater to the needs of property investors and landlords.

The Benefits of Buy to Let Mortgages

Investing in property through Buy to Let Mortgages offers several advantages, making it an appealing option for those looking to grow their wealth through real estate. Here are some key benefits:

1. Rental Income

One of the primary advantages of Buy to Let Mortgages is the potential to generate rental income. By investing in a property and renting it out to tenants, you can earn a regular stream of income, which can contribute to your financial stability and help you build wealth over time.

2. Property Appreciation

Properties have the potential to appreciate in value over time, which means that your investment could grow in worth. As property prices increase, so does the value of your asset. This appreciation can offer substantial returns on your investment, especially if you hold the property for an extended period.

3. Diversification of Portfolio

Buy to Let Mortgages provide an opportunity to diversify your investment portfolio. By allocating funds to real estate, you can balance your investment risk across different asset classes, reducing your exposure to market fluctuations and potentially increasing your overall return on investment.

4. Tax Benefits

In many countries, there are tax benefits associated with Buy to Let Mortgages. These benefits can include deductions for mortgage interest, maintenance costs, and other expenses related to the property. Consult with a tax professional to understand the specific tax advantages available in your jurisdiction.

5. Long-Term Capital Growth

Property investments, historically, have demonstrated long-term capital growth. By carefully selecting properties in high-demand areas and holding onto them for an extended period, you increase your chances of benefiting from significant appreciation in value, providing you with substantial capital gains.

Types of Buy to Let Mortgages

When considering a Buy to Let Mortgage, it is essential to understand the different types available to cater to your specific investment goals. Here are the primary types of Buy to Let Mortgages:

1. Fixed-Rate Mortgages

A fixed-rate Buy to Let Mortgage offers a set interest rate for a predetermined period, typically ranging from one to ten years. This stability allows you to plan your finances more effectively, as your monthly repayments remain unchanged during the fixed-rate period, regardless of any fluctuations in interest rates.

2. Tracker Mortgages

Tracker Mortgages have interest rates that are directly linked to a specific base rate, such as the Bank of England’s base rate. The interest rate on these mortgages fluctuates in line with the base rate, meaning your repayments may increase or decrease over time.

3. Discounted Mortgages

Discounted Mortgages offer a reduction on the lender’s standard variable rate (SVR) for a certain period. The discount rate can vary, and after the discounted period ends, the interest rate typically reverts to the lender’s SVR.

4. Offset Mortgages

Offset Mortgages link your mortgage with your savings or current account. The amount held in these accounts is offset against your mortgage balance, reducing the interest you pay. Offset Mortgages can be an effective way to save on interest payments while keeping your savings accessible.

5. Interest-Only Mortgages

Interest-Only Mortgages require you to repay only the interest charged on the loan each month. The principal balance remains unchanged, and you are responsible for repaying the full loan amount at the end of the mortgage term. These mortgages offer lower monthly repayments but require careful financial planning to ensure you can repay the loan at the end.

How to Get a Buy to Let Mortgage

Applying for a Buy to Let Mortgage involves several steps to ensure you meet the lender’s criteria. Here’s a guide on how to get a Buy to Let Mortgage:

1. Assess Your Finances

Before applying for a Buy to Let Mortgage, conduct a thorough assessment of your finances. Consider your income, existing debts, and credit history to determine your borrowing capacity and affordability. Lenders typically have strict criteria when it comes to Buy to Let Mortgages, so ensure you are financially prepared.

2. Research and Choose a Lender

Research different lenders and compare their Buy to Let Mortgage offerings. Look for competitive interest rates, favorable terms, and excellent customer service. It’s advisable to seek professional advice from a mortgage broker who specializes in Buy to Let Mortgages to help you navigate the market and find the best deal.

3. Find the Right Property

Identify suitable properties that align with your investment strategy and target market. Consider factors such as location, property type, rental potential, and potential for capital growth. Conduct thorough research to ensure the property meets your investment goals.

4. Prepare Your Documentation

Gather all the necessary documentation required by the lender, which typically includes proof of income, identification, bank statements, tax returns, and property details. Having these documents ready in advance will streamline the mortgage application process.

5. Complete the Application Process

Submit your mortgage application to the chosen lender. Provide accurate information and answer all questions truthfully. The lender will review your application, conduct credit checks, and assess the property’s viability for rental purposes. Be prepared to provide additional information or documentation if requested.

6. Mortgage Offer and Completion

If your application is successful, the lender will issue a mortgage offer detailing the loan terms and conditions. Review the offer carefully, ensuring you understand all the terms. Once you accept the offer, the lender will proceed with the necessary legal and financial arrangements, leading to the completion of the mortgage.

Conclusion

Buy to Let Mortgages offer a lucrative opportunity for individuals looking to invest in rental properties and generate income. By understanding the different types of mortgages, the application process, and key considerations, you can embark on your property investment journey with confidence.

Remember to conduct thorough research, seek professional advice when needed, and evaluate your financial capabilities before committing to a Buy to Let Mortgage. With proper planning and a sound investment strategy, you can maximize the potential of your property portfolio and achieve long-term financial growth.

FAQ 1: Can I get a Buy to Let Mortgage if I’m a first-time investor?

- Yes, it is possible to obtain a Buy to Let Mortgage as a first-time investor. However, lenders often have specific criteria for first-time buyers, such as requiring a higher deposit or a more thorough assessment of your financial circumstances. It is advisable to seek expert advice from a mortgage broker to understand the available options and increase your chances of approval.

FAQ 2: What is the minimum deposit required for a Buy to Let Mortgage?

- The minimum deposit required for a Buy to Let Mortgage typically ranges from 20% to 40% of the property’s value. However, this can vary depending on the lender and your individual circumstances. A larger deposit often leads to more favorable interest rates and borrowing terms.

FAQ 3: Can I live in a property financed by a Buy to Let Mortgage?

- No, Buy to Let Mortgages are specifically designed for investment properties and not for personal use. If you intend to live in the property, you should consider a residential mortgage instead.

FAQ 4: Can I use a Buy to Let Mortgage to purchase any type of property?

- Buy to Let Mortgages can be used to purchase various types of properties, including houses, apartments, flats, and even commercial properties like shops or offices. However, it’s important to check with your lender as they may have specific property criteria or restrictions.

FAQ 5: What is the difference between a Buy to Let Mortgage and a residential mortgage?

- The main difference between a Buy to Let Mortgage and a residential mortgage is the purpose of the property. Buy to Let Mortgages are intended for investment properties that will be rented out to tenants, while residential mortgages are used to purchase properties for personal use.

FAQ 6: How is the rental income assessed when applying for a Buy to Let Mortgage?

- Lenders typically assess the rental income potential of the property by considering factors such as the location, market demand, rental market trends, and the property’s rental history. They may require a rental valuation or a rental income forecast to determine the property’s suitability for a Buy to Let Mortgage.

FAQ 7: Can I switch my existing residential mortgage to a Buy to Let Mortgage?

- In some cases, it may be possible to switch your existing residential mortgage to a Buy to Let Mortgage if you decide to convert your property into a rental investment. However, this will depend on your lender’s policies and approval criteria. It’s advisable to consult with your lender or a mortgage broker to explore your options.

FAQ 8: Are Buy to Let Mortgages interest-only or repayment mortgages?

- Buy to Let Mortgages can be either interest-only or repayment mortgages. Interest-only mortgages allow you to pay only the interest charged on the loan each month, while repayment mortgages require you to make monthly repayments that include both the principal and interest. It’s important to discuss the options with your lender and consider your financial goals.

FAQ 9: Can I use a Buy to Let Mortgage to renovate a property?

- Yes, it is possible to use a Buy to Let Mortgage to finance property renovations or refurbishments. However, lenders may have specific requirements or limitations regarding the extent of renovations and the impact on the property’s rental value. It’s important to discuss your renovation plans with the lender beforehand.

FAQ 10: What happens if I can’t find tenants for my Buy to Let property?

- If you’re unable to find tenants for your Buy to Let property, it can impact your rental income. However, it’s important to have a contingency plan and budget for potential periods of vacancy. You may need to explore alternative marketing strategies, consider adjusting the rental price, or seek professional advice to attract tenants.

FAQ 11: Can I switch Buy to Let Mortgage lenders?

- Yes, it is possible to switch Buy to Let Mortgage lenders. However, you should consider any early repayment charges or exit fees associated with your current mortgage and compare them against potential savings or benefits from switching. Consulting with a mortgage broker can help you evaluate the options and make an informed decision.

FAQ 12: Can I use a Buy to Let Mortgage for short-term holiday rentals?

- Some lenders offer specific Buy to Let Mortgage products for short-term holiday rentals, such as properties listed on platforms like Airbnb. However, these mortgages may have different criteria and higher interest rates compared to traditional Buy to Let Mortgages. It’s advisable to check with your lender and ensure that the property meets their requirements for short-term rentals.

FAQ 13: Can I use a Buy to Let Mortgage to purchase a property abroad?

- Yes, it is possible to use a Buy to Let Mortgage to purchase a property abroad. However, the availability and terms of such mortgages may vary depending on the lender and the country in which you plan to invest. It’s advisable to consult with mortgage brokers who specialize in international property investments to explore your options and navigate the process.

FAQ 14: Can I remortgage my Buy to Let property to release equity?

- Yes, remortgaging your Buy to Let property is a common way to release equity. By refinancing your existing mortgage, you can borrow against the increased value of your property and access the released equity for other purposes, such as purchasing additional properties or making renovations. However, it’s important to assess the financial implications and seek professional advice before proceeding with a remortgage.

FAQ 15: What happens if my rental income doesn’t cover the mortgage repayments?

- If your rental income does not cover the mortgage repayments, it can put a strain on your cash flow. In such cases, you may need to supplement the shortfall from your personal funds. It’s essential to have a contingency plan and budget for potential periods of negative cash flow. Additionally, reviewing your rental price, reducing expenses, or seeking professional advice can help mitigate the situation and improve your rental income over time.

These FAQs provide further insights into specific aspects of Buy to Let Mortgages, addressing concerns related to international property investments, releasing equity, and managing cash flow challenges.

Leave a Reply