“Looking for the best mortgage rates in the UK? Explore our comprehensive guide to finding the perfect home financing option. From factors affecting mortgage rates to tips for securing the best deal, we’ve got you covered. Don’t miss out on your dream home—start your journey today!”

Are you in the market for a new home in the UK? One of the most crucial factors to consider is securing the best mortgage rates. Finding the right mortgage can have a significant impact on your financial future. In this comprehensive guide, we will explore everything you need to know about finding the best mortgage rates in the UK. From understanding the key factors that influence mortgage rates to tips for getting the best deal, we’ve got you covered.

Understanding Mortgage Rates

Mortgage rates refer to the interest rates charged by lenders on home loans. They determine the amount you’ll pay in interest over the life of your mortgage. Mortgage rates can vary depending on several factors, including the type of mortgage, the lender’s assessment of your risk, and prevailing market conditions.

Factors Affecting Mortgage Rates

Several factors influence mortgage rates in the UK. These include the Bank of England’s base rate, inflation, the lender’s cost of funds, the term of the mortgage, and the borrower’s creditworthiness. Understanding these factors can help you navigate the mortgage market effectively.

Types of Mortgages in the UK

In the UK, there are various types of mortgages available, including fixed-rate mortgages, adjustable-rate mortgages, and interest-only mortgages. Each type has its own advantages and disadvantages, so it’s essential to choose the one that best suits your financial situation and long-term goals.

How to Find the Best Mortgage Rates

Finding the best mortgage rates requires research and comparison. Start by approaching different lenders, such as banks, building societies, and mortgage brokers. Compare the rates, fees, and terms they offer. Utilize online comparison tools and consult with mortgage professionals to get a comprehensive view of the available options.

Comparing Mortgage Rates

When comparing mortgage rates, it’s important to look beyond the initial rate. Consider any additional fees or charges associated with the mortgage. These can include arrangement fees, valuation fees, and early repayment charges. By factoring in these costs, you can get a more accurate picture of the overall affordability of a mortgage.

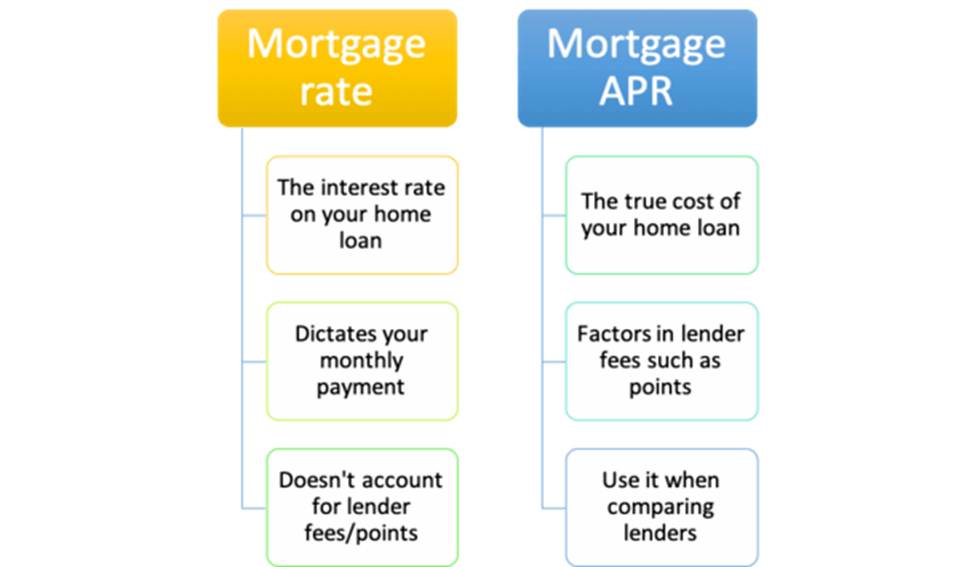

Mortgage Rates vs. APR

While mortgage rates are a vital consideration, it’s also crucial to understand the Annual Percentage Rate (APR). The APR includes both the interest rate and any additional charges associated with the mortgage. It provides a more comprehensive view of the total cost of borrowing and allows for a more accurate comparison between different mortgage offers.

The Role of Credit Score

Your credit score plays a significant role in determining the mortgage rate you’ll be offered. Lenders use credit scores to assess the risk associated with lending to you. A higher credit score usually results in more favorable mortgage rates, while a lower score may lead to higher rates or even rejection. It’s essential to maintain a good credit score by paying bills on time and managing debts responsibly.

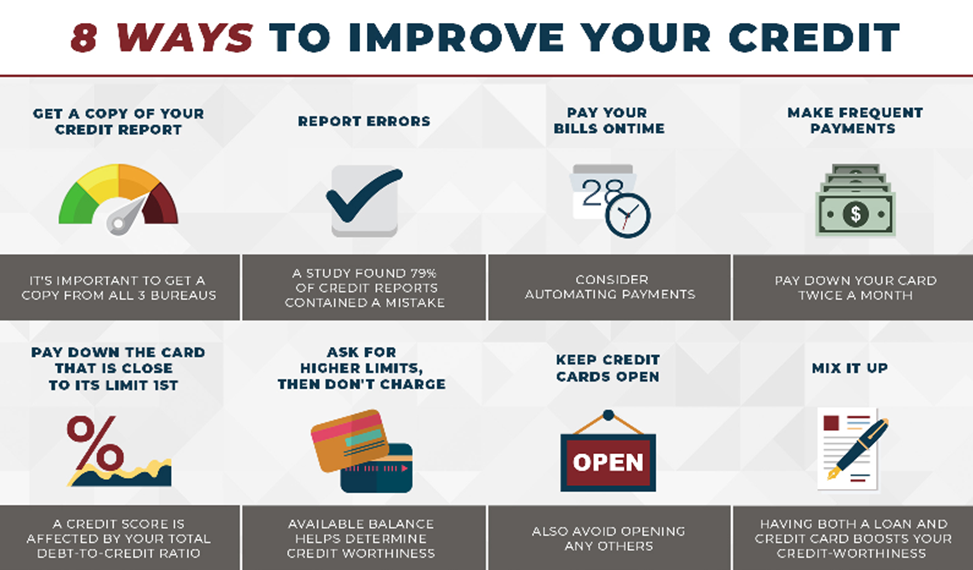

How to Improve Your Credit Score

If your credit score is less than ideal, there are steps you can take to improve it. These include paying bills on time, reducing existing debt, and avoiding unnecessary credit applications. Regularly checking your credit report for errors and disputing inaccuracies can also help improve your credit score over time.

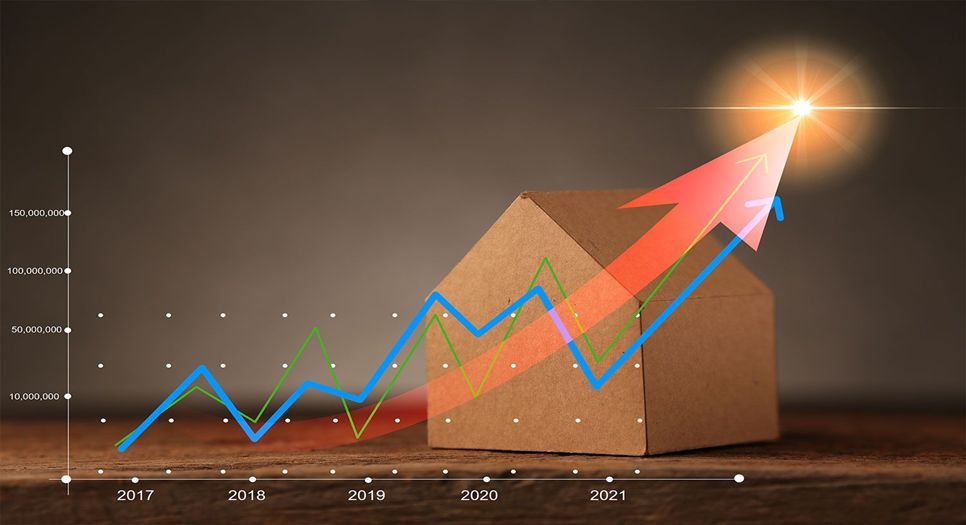

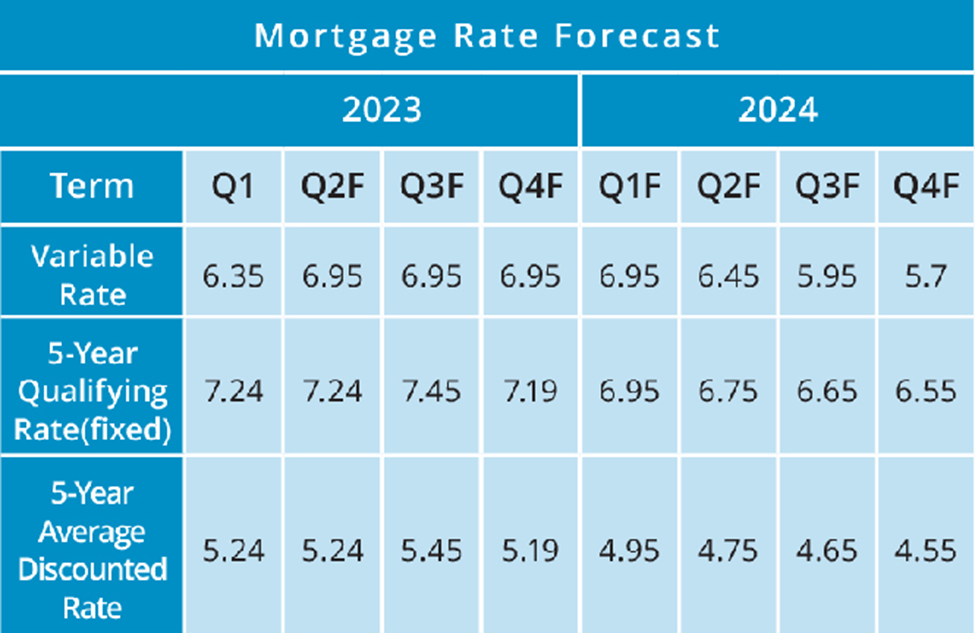

Mortgage Rate Forecast

Mortgage rates can fluctuate due to various economic factors. While it’s challenging to predict future mortgage rates accurately, staying informed about market trends can be beneficial. Following economic indicators and consulting with mortgage experts can help you make informed decisions about when to lock in a mortgage rate.

Choosing the Right Lender

Selecting the right lender is crucial when looking for the best mortgage rates. Consider factors such as reputation, customer service, and the lender’s commitment to transparency. Reading reviews and seeking recommendations can also provide valuable insights into the experiences of other borrowers.

The Importance of Mortgage Advice

Seeking professional mortgage advice can be highly beneficial, especially for first-time buyers or those with complex financial situations. Mortgage advisors can help you navigate the mortgage market, understand the available options, and find the best mortgage rates tailored to your specific needs.

Considerations for First-Time Buyers

First-time buyers face unique challenges when entering the property market. They may qualify for special mortgage products or government schemes designed to assist them. Understanding these options, as well as the associated mortgage rates, can help first-time buyers make informed decisions and secure their dream homes.

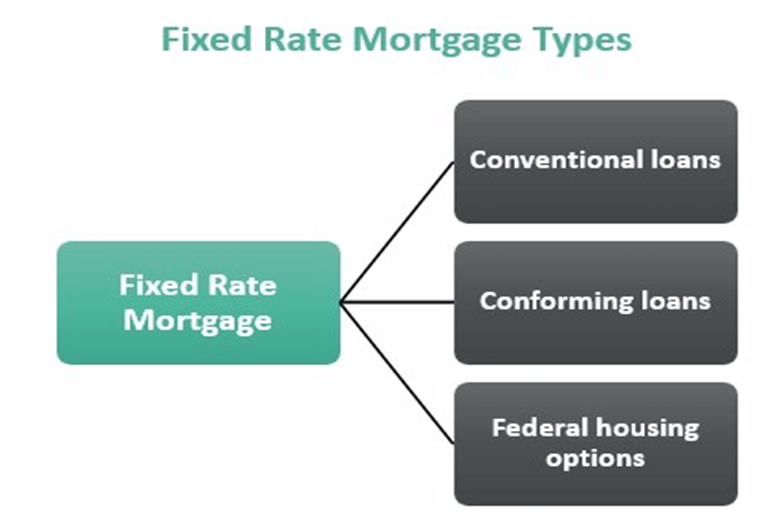

Benefits of Fixed-Rate Mortgages

Fixed-rate mortgages offer stability and predictability. With a fixed-rate mortgage, your interest rate remains the same for a specific period, typically between two and ten years. This allows you to budget accurately, knowing that your monthly mortgage payments won’t change during the fixed-rate period, regardless of any interest rate fluctuations in the market.

Pros and Cons of Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) come with interest rates that can fluctuate based on market conditions. While ARMs may initially offer lower rates than fixed-rate mortgages, they come with the risk of increasing rates in the future. ARMs can be suitable for borrowers who plan to sell their property before the rate adjustment period begins or those who expect interest rates to decrease in the future.

Consider a Mortgage Broker

Working with a mortgage broker can be beneficial when searching for the best mortgage rates. Brokers have access to a wide range of lenders and can help you find the most suitable options based on your financial situation. They can also negotiate on your behalf to secure favorable rates.

Be Prepared to Negotiate

Don’t be afraid to negotiate with lenders. If you have a good credit score and a stable financial position, you may be able to negotiate for a lower interest rate or better terms. Be proactive and present multiple offers to leverage better deals.

FAQs About Mortgage Rates in the UK

Q: What is the current average mortgage rate in the UK?

- A: As mortgage rates can fluctuate, it’s essential to check with different lenders to get an accurate picture of the current average rates.

Q: How can I calculate my mortgage affordability?

- A: Use online mortgage calculators that take into account factors such as your income, expenses, and down payment to determine your affordability.

Q: Is it possible to get a mortgage with bad credit?

- A: While it may be more challenging, it is still possible to secure a mortgage with bad credit. However, you may face higher interest rates or stricter terms.

Q: Should I choose a fixed-rate or adjustable-rate mortgage?

- A: The choice between a fixed-rate and adjustable-rate mortgage depends on your financial goals and risk tolerance. Consider your long-term plans before making a decision.

Q: How much of a down payment do I need to secure a mortgage?

- A: The down payment requirement varies based on the lender and the type of mortgage. In the UK, most lenders expect a minimum of 5% to 20% of the property’s value.

Q: Can I switch my mortgage to a different lender to get a better rate?

- A: Yes, it is possible to switch your mortgage to a different lender to take advantage of better rates. However, consider the costs involved and compare the overall savings before making a decision.

Q: What is a tracker mortgage, and how does it affect my interest rate?

- A: A tracker mortgage is a type of variable-rate mortgage where the interest rate is linked to the Bank of England’s base rate. As the base rate fluctuates, so does your mortgage rate, typically by a set percentage above or below the base rate.

Q: Can I get a mortgage with a self-employed status?

- A: Yes, being self-employed doesn’t disqualify you from obtaining a mortgage. However, the process may be slightly different, and lenders typically require additional documentation to assess your income stability.

Q: Are there any additional costs or fees associated with getting a mortgage?

- A: Yes, there may be various fees involved, such as arrangement fees, valuation fees, legal fees, and stamp duty. It’s essential to factor in these costs when budgeting for your mortgage.

Q: Can I overpay on my mortgage to reduce the total interest paid?

- A: Many mortgage agreements allow borrowers to overpay on their mortgage without penalties. By making extra payments, you can reduce the outstanding balance and potentially shorten the mortgage term, resulting in less interest paid overall.

Q: What is a standard variable rate (SVR) mortgage?

- A: An SVR mortgage is a type of mortgage where the interest rate is set by the lender and can fluctuate at their discretion. SVR rates are typically higher than other mortgage options, making it beneficial to switch to a different deal when possible.

Q: How long does the mortgage application process usually take?

- A: The mortgage application process can vary depending on factors such as the lender, your financial situation, and the complexity of the transaction. On average, it takes around four to six weeks from application to approval.

Q: What is a mortgage agreement in principle (AIP)?

- A: A mortgage agreement in principle, also known as a decision in principle or mortgage promise, is a statement from a lender indicating the amount they would be willing to lend you based on an initial assessment. It helps demonstrate your borrowing capacity when making an offer on a property.

Q: Can I remortgage my property to get a better rate?

- A: Yes, remortgaging is the process of switching your mortgage to a new lender or product to take advantage of better rates or terms. It’s important to assess any associated costs and consider the potential savings before deciding to remortgage.

Q: What is a mortgage rate lock, and how does it work?

- A: A mortgage rate lock allows borrowers to secure an agreed-upon interest rate for a specified period, typically between 30 and 90 days. This provides protection against rate fluctuations during the home-buying process, giving you peace of mind.

Remember to consult with a mortgage advisor or financial professional to get personalized guidance and advice based on your specific circumstances.

Conclusion

Securing the best mortgage rates in the UK is a critical step towards achieving your dream of homeownership. By considering the factors that influence mortgage rates and employing effective strategies for finding the most competitive rates, you can save thousands of pounds over the life of your mortgage. Remember to shop around, improve your credit score, and consider working with a mortgage broker to maximize your chances of finding the best mortgage rates. Happy house hunting!

Leave a Reply