This article provides a step-by-step guide on how to apply for a mortgage in the UK, including information on mortgage types, eligibility, affordability, preparing for the application, choosing the right lender, gathering documents, submitting the application, the approval process, and what to do after approval.

Buying a home is a major life decision, and one of the most important steps in the process is applying for a mortgage. A mortgage is a loan that you use to finance the purchase of a property, and it is one of the biggest financial commitments you will ever make. The mortgage application process can be complex and time-consuming, but it is important to do your research and understand the steps involved to ensure that you are approved for the best possible mortgage deal.

Understanding Mortgages in the UK:

A mortgage is a loan that is secured against a property. This means that if you default on the loan, the lender can take possession of your property and sell it to recover the money owed.

There are different types of mortgages available, each with its own advantages and disadvantages. The most common types of mortgages in the UK are:

Fixed-rate mortgages: These mortgages have an interest rate that remains fixed for a set period of time, usually two, five, or ten years. This can provide peace of mind knowing that your monthly payments will not change for the duration of the fixed rate period.

Variable-rate mortgages: These mortgages have an interest rate that can change over time, based on the Bank of England base rate. Variable-rate mortgages can offer lower initial interest rates than fixed-rate mortgages, but the interest rate could rise in the future, which could lead to higher monthly payments.

Tracker mortgages: These mortgages track the Bank of England base rate. This means that your interest rate will be the same as the Bank of England base rate, plus a margin. Tracker mortgages can offer competitive interest rates, but they are not as flexible as fixed-rate mortgages, as your interest rate will change whenever the Bank of England base rate changes.

Mortgage Eligibility and Affordability:

In order to be eligible for a mortgage, you will need to meet certain criteria. The lender will assess your credit score, income stability, and debt-to-income ratio to determine your eligibility.

- Your credit score is a number that lenders use to assess your creditworthiness. It is based on your credit history, which includes information such as your payment history, the amount of debt you have, and the length of your credit history. A good credit score will make you more likely to be approved for a mortgage, and it could also lead to a lower interest rate.

- Your income stability is another important factor that lenders consider. Lenders want to be sure that you will be able to make your monthly mortgage payments on time, even if your income changes. If you have a stable job with a steady income, you will be more likely to be approved for a mortgage.

- Your debt-to-income ratio is a measure of how much debt you have compared to your income. Lenders want to see that you can afford to make your monthly mortgage payments, as well as your other debts, such as credit card debt and student loans. A high debt-to-income ratio could make it more difficult to get approved for a mortgage.

Preparing for the Mortgage Application:

There are a few things you can do to prepare for the mortgage application process. These include:

- Get your finances in order: This includes getting your credit report, paying down debt, and saving for a deposit.

- Research different lenders: Compare interest rates, fees, and other terms and conditions to find the best deal.

- Get pre-approved for a mortgage: This will give you an idea of how much you can borrow and what your monthly payments will be.

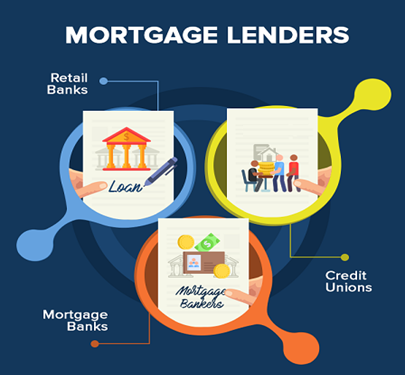

- Choosing the Right Mortgage Lender

Shop around:

There are many different mortgage lenders available, so it is important to shop around and compare rates and terms. Some factors to consider when choosing a lender include:

Interest rates: This is the most important factor for many borrowers.

Fees: Lenders may charge fees for things like application, appraisal, and processing fees.

Loan terms: This includes the length of the loan and the repayment schedule.

Customer service: It is important to choose a lender with good customer service, in case you need to contact them with any questions or problems.

Gathering the Required Documents:

In order to complete your mortgage application, you will need to provide the lender with certain documents. These documents will vary depending on the lender, but they typically include:

- Proof of identity: This could be a passport, driver’s license, or other government-issued identification.

- Proof of income: This could be a recent pay stub, tax return, or other documentation showing your income.

- Proof of employment: This could be a letter from your employer stating your job title, salary, and length of employment.

- Proof of address: This could be a recent utility bill, bank statement, or other documentation showing your current address.

Submitting the Mortgage Application:

Once you have gathered all of the required documents, you can submit your mortgage application to the lender. The lender will review your application and make a decision on whether to approve you for a mortgage. If you are approved, the lender will provide you with a mortgage offer.

The Mortgage Approval Process:

The mortgage approval process can take several weeks or even months. During this time, the lender will conduct a credit check, verify your employment and income, and appraise the property you are buying. If everything is in order, the lender will issue you a mortgage offer.

After the Mortgage Approval:

Once you have been approved for a mortgage, you will need to sign the mortgage offer and close on the property. At closing, you will pay the down payment, closing costs, and first mortgage payment. You will also receive the keys to your new home.

Additional Tips:

Here are some additional tips for applying for a mortgage:

- Get pre-approved for a mortgage before you start looking at properties. This will give you an idea of how much you can afford and will make the buying process go more smoothly.

- Shop around for the best interest rate and terms. There are many different mortgage lenders available, so it is important to compare rates and fees before you choose a lender.

- Be prepared to provide the lender with all of the required documentation. This will help to speed up the approval process.

- Ask questions if you do not understand anything. The lender should be happy to answer any questions you have about the mortgage process.

Applying for a mortgage can be a daunting task, but it is important to remember that you are not alone. There are many resources available to help you through the process, including mortgage lenders, financial advisors, and government agencies. With careful planning and preparation, you can successfully apply for a mortgage and achieve your homeownership goals.

Q.1 What are the different types of mortgages available in the UK?

There are many different types of mortgages available in the UK, each with its own advantages and disadvantages.

Q.2 What are the eligibility requirements for a mortgage in the UK?

In order to be eligible for a mortgage in the UK, you will need to meet certain criteria. The lender will assess your credit score, income stability, and debt-to-income ratio to determine your eligibility.

Q.3 What are the steps involved in applying for a mortgage in the UK?

The steps involved in applying for a mortgage in the UK are as follows:

- Get pre-approved for a mortgage

- Choose a lender

- Gather the required documentation

- Proof of identity

- Proof of income

- Proof of employment

- Proof of address

- Submit your application

- Wait for approval

- Sign the mortgage offer and close on the property

Q.4 What are the closing costs associated with a mortgage in the UK?

The closing costs associated with a mortgage in the UK can vary depending on the lender, but they typically include:

- Appraisal fee

- Legal fees

- Title insurance

- Recording fees

- Other fees

Q.5 What are the benefits of having a mortgage in the UK?

There are many benefits to having a mortgage in the UK, including:

- The ability to own your own home

- Tax relief

- Security

- Investment

- Flexibility

Q.6 What are the risks of having a mortgage in the UK?

There are some risks associated with having a mortgage in the UK, including:

- Interest rate changes

- Job loss

- Medical problems

- Natural disasters

- Repossession

Q.7 How can I improve my chances of getting approved for a mortgage in the UK?

There are a few things you can do to improve your chances of getting approved for a mortgage in the UK, including;

- Get a good credit score

- Get a stable job

- Reduce your debt

- Save for a down payment

- Get pre-approved for a mortgage

Q.8 What are some tips for managing my mortgage in the UK?

Here are some tips for managing your mortgage in the UK;

- Make your payments on time

- Keep your debt-to-income ratio low

- Pay down your principal balance

- Consider refinancing

- Shop around for the best interest rate

Q.9 What are some resources available to help me with my mortgage in the UK?

There are many resources available to help you with your mortgage in the UK, including;

- Your lender

- The government

- Financial advisors

- Consumer groups

Q.10 What are some things I should keep in mind when applying for a mortgage in the UK?

Here are some things you should keep in mind when applying for a mortgage in the UK;

- The mortgage process can be complex.

- It can take time to get approved for a mortgage.

- There are many different types of mortgages available.

- Mortgages are a long-term commitment.